It was reported today in various media accounts that workers at the Beta Hunt mine near Kambalda in Western Australia had brought more than $15 million worth of gold specimens to the surface in just four days. The mine’s owner, Canada’s RNC Minerals (TSX: RNX), published a release on Sunday to the Canadian market to this effect.

The gold-encrusted rocks were found about 500 metres below the surface in an area measuring just three metres wide and three metres high. The largest specimen weighs in at 90kg and took three men to lift it onto the back of a ute. The quartz rock is covered in an estimated 2,300 ounces of gold worth about $3.8 million at today’s gold price. Another 60kg specimen is estimated to contain 1,600 ounces, or about $2.6 million in gold. The rich cluster of high-grade gold has so far produced more than 9,000 ounces.

The irony is that the Beta Hunt mine, located 630km east of Perth, has been mined for nickel since the 1970s, with gold tending to play second fiddle. There are stories among the workforce dating back to the early days of the mine which suggest similar bonanza finds may have been made in the past, but were not considered significant at the time because of low gold prices. There are also tales that workers in those days would bury bags of gold rocks in the event the price would eventually recover.

Kambalda Background

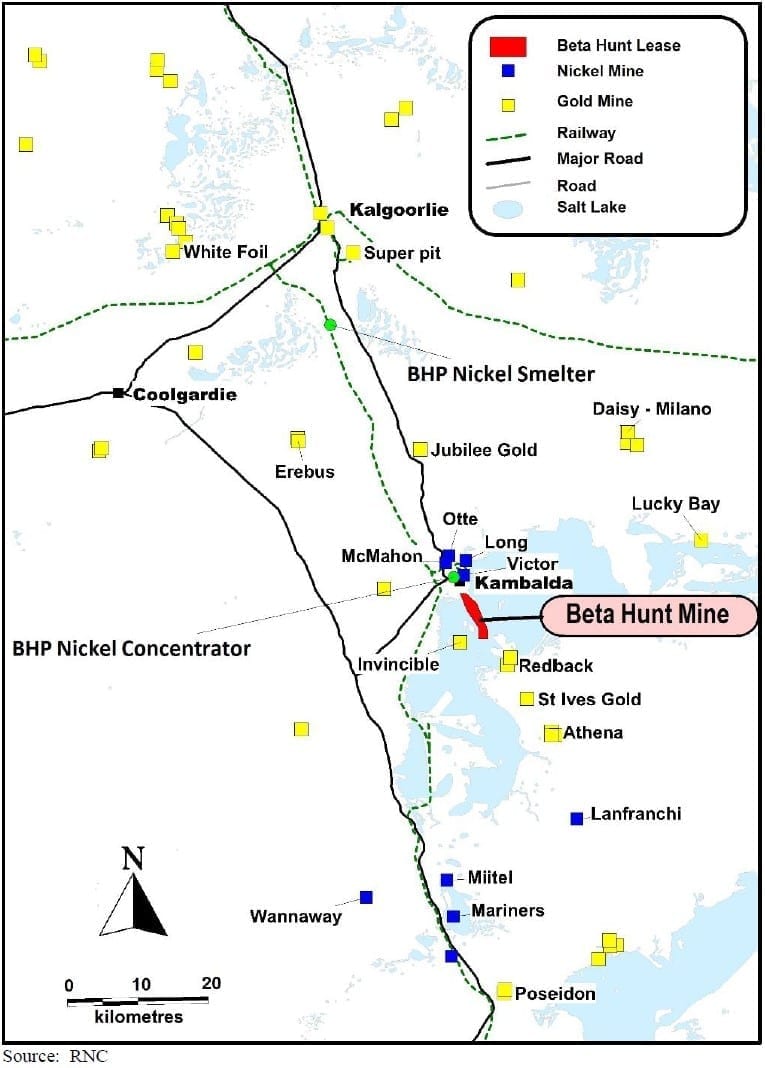

The Beta Hunt Mine is located within the prolific Kambalda mining district of Western Australia. It’s a long-established major mining centre with excellent existing infrastructure, a skilled local workforce and nearby nickel and gold processing mills.

Beta Hunt was originally a core WMC (Western Mining Co) asset that was discovered in 1966, producing 153,500 tonnes of nickel metal up to 1998. It was sold to Gold Fields Limited in 2001. In 2003, Reliance Mining acquired nickel rights for A$11.7M, then developed an operation that was acquired by Consolidated Minerals for A$76.5M in 2005. Consolidated Minerals placed the mine on care-and-maintenance at the end of 2008.

The Beta Hunt Mine was acquired by SLM in 2013 for A$10M after securing gold mining rights from Gold Fields Limited. The mine began producing nickel in 2014 and began gold production in November 2015. RNC expects to ramp up gold production to an annualized rate of approximately 60,000 ounces by the end of the first quarter of 2017.

Interestingly, Beta Hunt is a deposit with the very rare feature of hosting both nickel and gold resources in adjacent discrete mineralized zones. The mining tenements on which the Beta Hunt Mine is located are held by South Africa’s Gold Fields Limited. SLM operates the Beta Hunt Mine by virtue of a sub-lease agreement with Gold Fields Limited. The SLM land package includes significant exploration opportunities at Beta Hunt to add to the SLM resources alongside production.

Figure 1: Beta Hunt Location Map

Technical Significance

These latest discoveries highlight the high-grade gold potential of Beta Hunt and will likely generate a renewed interest in the deep gold potential around Kambalda.

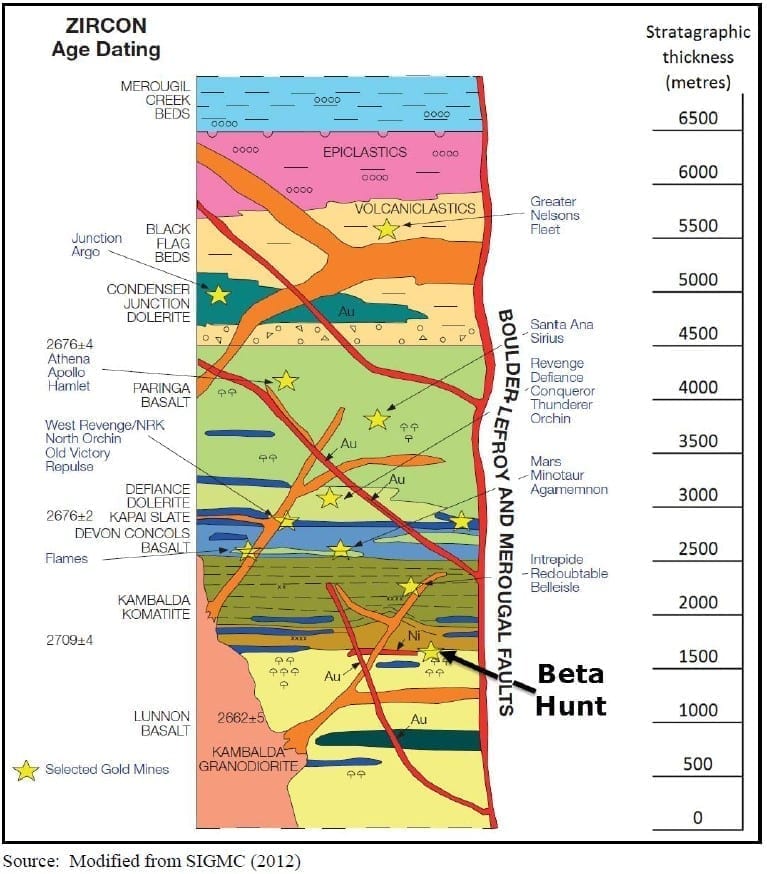

Beta Hunt is situated within the central portion of the Norseman-Wiluna greenstone belt in a sequence of mafic/ultramafic and felsic rocks on the southwest flank of the Kambalda Dome. Nickel mineralization is hosted mainly by talc-carbonate and serpentine altered ultramafic rocks and is typically pyrrhotite-pentlandite-pyrite+- chalcopyrite. Gold mineralization occurs mainly in the Lunnon Basalt, which is the footwall to the nickel-bearing ultramafics, and is characterized by intense albite, carbonate and chlorite alteration, with a halo of biotite/pyrite alteration.

Interestingly, RNC is the first owner of the Beta Hunt Mine to focus on drilling deeper within the Lunnon Basalt in its search for gold (refer to graphic below) – and therefore the first owner to discover and mine gold from newly-discovered coarse gold located entirely within the Lunnon Basalt. Previous bonanza grade specimen stone occurrences at Beta Hunt were associated with the nickel-sulphide-bearing contact between the Lunnon Basalt and the overlying Kambalda Komatiite, where nickel mining has been focused by RNC and previous operators.

Figure 2: Stratigraphy Relationships within the St Ives Area

Based on diamond drilling and underground mapping, there are two or more Lunnon sediment bands comprising a zone of narrow (< 0.3m), strongly pyritic black shale horizons positioned approximately 150m stratigraphically below the Lunnon Basalt/Kambalda Komatiite nickel contact. This sediment horizon is well documented in published literature – and is recognized as a marker unit in differentiating the Upper and Lower Lunnon Basalt.

The sediment horizon is now also interpreted by geologists at the Beta Hunt Mine as a zone of chemical interaction between the gold-bearing fluids and pyritic sulfides, which under the right conditions allow large gold crystal growth and extremely high-grade gold deposition.

The structure found last week is located in a dilation zone that contains sheared pyritic sediments, porphyry and Lunnon basalt and a large amount of coarse gold and specimen stone. Understanding the depositional model for this new gold mineralization provides potential for future exploration and discovery of high-grade gold material at the sediment marker layer, which runs along all known shear structures located at the Beta Hunt Mine.

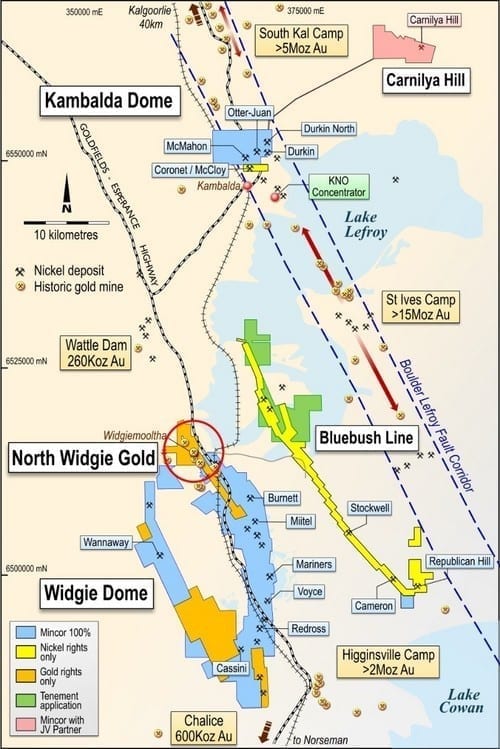

Figure 3: Mincor Resources’ Kambalda region holdings

Regional Players

Importantly too, it will shine a light on other key players within the Kambalda region – namely South African major Gold Fields Limited and Aussie junior Mincor Resources (ASX: MCR) – who have maintained a significant regional presence for some time now.

Gold Fields is this year spending $37 million at its St Ives gold project near Kambalda, a near 400,000 ounce a year producer. Gold Fields is targeting extensions and deposits along strike from the Invincible discovery, where underground stoping began during Q2 2018. Gold Fields is also looking at advanced geophysical surveys using new technology to test whether old ope- pits at the complex could become underground developments.

Mincor Resources meanwhile has played a leading role in the post-2001 revival of the Kambalda nickel district and remains the dominant holder of nickel-prospective ground within the district. It continues to own and progress feasibility-level nickel projects as well as numerous resource-level and advanced stage exploration projects within the Kambalda District.

Summary

The latest bonanza discovery at RNC Minerals’ Beta Hunt mine will generate further appreciation of the deep potential within Western Australia’s gold fields, not just Kambalda. The history of the gold mining industry within Australia has resulted in a near-surface focus – both in terms of exploration and mining, with not a lot of deep exploration – let alone mining. Ironically, it has taken a Canadian company with a focus on its emerging nickel-cobalt mine in Quebec, to reinforce the deep potential of Kambalda.

When we examine the context of the West Australian gold industry generally that has largely relied on shallow open-pit mining, compared to that of the South African gold industry where deep mines extend down to at around 4km, we see that there is enormous untapped potential. It will therefore be interesting to see the results of follow up exploration work around Kambalda targeting the Lunnon basalt in the search for gold.

Stock to Watch – Mincor Resources (ASX: MCR, Share Price: $0.37, Market Cap: $78m)

Disclaimer: Gavin Wendt, who is a director of Mine Life Pty Ltd ACN 140 028 799, compiled this document. It does not constitute investment advice. I wrote this article myself, it expresses my own opinions and I am not receiving compensation for it. In preparing this article, no account was taken of the investment objectives, financial situation and particular needs of any particular person. Investors need to consider, with or without the assistance of a securities adviser, whether the information is appropriate in light of the particular investment needs, objectives and financial circumstances of the investor. Although the information contained in this publication has been obtained from sources considered and believed to be both reliable and accurate, no responsibility is accepted for any opinion expressed or for any error or omission in that information. I have no positions in the stock mentioned and no plans to initiate any positions within the next 72 hours.