Could you talk about the Singapore Bullion Market Association – its background and history, and what you do there?

The Singapore Bullion Market Association (SBMA) was established in 1993 as a non-profit association with 16 founding members. In the early 90s, Singapore lacked the necessary expertise for the bullion market. For 10 years, the SBMA remained dormant until the government decided to put efforts into developing a gold trading policy, and aimed to make Singapore one of the major gold hubs in Asia

In order to accomplish this goal, the SBMA and the precious metal community engaged the Goods and Services working committee in discussions relating to the exclusion of GST on precious metals and in 2012, the Singaporean government finally removed the GST on the importation of Investment Precious Metals (IPMs). After the removal of the GST, the World Gold Council reported that gold Transactions rose 94% within a year.

The government also provides incentives to attract foreign refiners and international market players to establish their operations in Singapore. One major incentive is the Approved Refinery and Consolidator Scheme (ARCS) that exempts precious metal refiners from the GST on the importation of materials that are processed into IPM.

SBMA, with the support of Enterprise Singapore and its members, is commissioned to raise the status of Singapore as a gold trading hub. Albert Cheung, previously the Regional Managing Director of the World Gold Council, was appointed to head the SBMA in 2015 to carry out the commission. More recently, SBMA has grown to around 45 members, mostly based in Singapore. The members include banks, refineries, logistics companies, and international PM trading houses. SBMA held its inaugural Asia Pacific Precious Metals Conference (APPMC) in 2017, which was attended by over 330 delegates coming from 23 countries. We also successfully concluded our second APPMC in June 2018 where we welcomed 358 delegates representing 173 companies from 29 countries. Our third annual APPMC will be held on the 9th – 11th June 2019.

How is the gold market performing in Asia, and what role do you see Singapore playing in Asia’s trading of gold?

SBMA aims to have Singapore representing the entire precious metals ASEAN market and aspires to become the go-to hub for the region. This includes sourcing, trading, hedging, clearing and storing of bullion in Singapore.

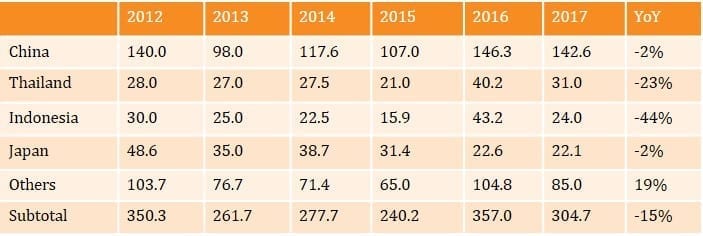

We hope that Singapore can act as a focal point for the entire precious metals supply chain. That includes suppliers of recycled gold and LBMA-accredited large bars, traders, refineries, consumers, as well as end-users. Regarding recycled gold*, we have seen that the amount of recycled gold equaled 304 tonnes in 2017 in East Asia, according to Metals Focus.

Is improved access to banking and smartphone-enabled digital financial services seen as a threat to gold’s traditional role as a major store of wealth across Asia?

An emerging trend is the use of AI in bullion trading. AI is helping to upgrade services to increase trading efficiency and minimise operational risks. However, gold is still irreplaceable as is the need for a place to store it. With ongoing changes in socioeconomic factors, changes in attitudes and a larger middle-class population in Asia, there is still a need for wealth to be stored safely. In this regard, Singapore is a great place to store wealth, with reputable international logistics service providers like Loomis and Brinks who are trusted for their ability to transport and store bullion, and the state-of-theart Le Freeport situated in Changi Airport, which is regarded as Singapore’s Fort Knox for storage of collectibles and precious metals.

Another new digital innovation is the use of block chain and the emergence of fintech platforms where the middle class can purchase gold bars through online functions or purchase the digital value of the gold. Users can expect to benefit from digital financial services where they can purchase gold online and use either China, Hong Kong, or Singapore as a delivery point.

Recycled gold (by tonnes)

* Recycled gold = Scrap + Disinvestment + Individual residual

As a leading precious metals hub in the region, what are Singapore’s competitive advantages?

In addition to the points I referenced above, here are few points on Singapore as a leading precious metals hub:

- No GST on investment grade precious metals

- World-class financial infrastructure

- A financial and wealth management hub

- Politically stable with strong rule of law

- Strong governmental support to the industry

- SBMA support for market participants

- Latest credit rating for Singapore

The proximity and centrality of the ASEAN market helps to complement the above-mentioned points. This includes a well-developed supply chain. Also, Southeast Asia still has scrap gold floating through markets. Increasingly, locals will want to use a trusted site to recycle that gold and send it to refineries to upgrade to Kilo bars. In Southeast Asia, this makes a big difference, as previously you might have had to go to Northeast Asia, Europe, or North America to do this.

What are some of the risks in the long term that will impact bullion markets globally?

I spoke earlier about the AI applications in finance and the role of Fintech. While there are benefits to these, there are also risks associated with them. A concern with fintech is that their platforms may have more risk and liability of defaults or bankruptcies. For instance, if gold is purchased digitally and is connected to an at-risk Fintech platform, the gold asset could be at risk if there is a default.

How do you see the gold market performing thus far in 2018?

I think the gold price will go up once the impacts of trade disputes begin to spread more globally. People will return to gold as a safe haven for their wealth. Right now, gold is under pressure due to the strength of the US dollar and the robustness of stock markets.

What I predict is that gold prices will be between $1100 – $1400 this year. Going into 2019, the average price will be $1250. However, if the trade war(s) intensify, the average price might go higher to $1350.

Does SBMA see any risks during the ongoing trade disputes between the US and its trading partners?

There are two risks that SBMA is seeing regarding the trade disputes:

With the US putting sanctions on Turkey, whose economy has been struggling this year, there’s now further pressure on Turkey to deal with a slowing economy and sanctions. This has had an impact on Turkish currency, as you’ve probably seen with the Lira. Turkey is a major gold hub for the Middle East market, as a location for buyers and sellers in the region. Thereby, Turkey acts as a major gold hub that serves as a gateway to connect Europe and the Middle East. If the Lira continues to lose value, people will lose trust in the Lira and then start putting their money into safe havens like gold. This will have inflationary impacts and will impact the connection that Turkey has to the wider Middle East and Islamic world.

The other major concern is the US and China trade conflict. Inflationary pressures are already being caused by the increasing sanctions on both countries exports / imports. The US dollar is currently keeping its value, but eventually, these trade wars will drive up global inflation. In these countries, people will lose confidence in their currencies, and the demand to store wealth in gold will increase. This will be especially acute in China since the Renminibi is already depreciating, which will make it difficult for people in China to invest abroad, therefore, they will likely be encouraged to invest in gold to protect their wealth.