The global lithium market has undergone a remarkable transformation in recent years, driven largely by the surge in demand for electric vehicles (EVs) and the broader calls of a green revolution. As a crucial component in EV batteries, lithium has transitioned from relative obscurity to the forefront of commodity markets. The green revolution, fuelled by the urgency to combat climate change, has spawned a growing interest in renewable energy sources and sustainable technologies.

EVs have emerged as a key player in this movement, promising to reduce carbon emissions and dependence on fossil fuels. As a result, the demand for EVs (and in turn lithium-ion batteries) soared. Consequently, the lithium market transitioned from surplus to deficit, catching many stakeholders off guard.

This shift in dynamics prompted a scramble among automakers, tech companies, and governments to secure a stable supply of lithium. Mines were expanded, new projects were initiated, and exploration efforts intensified. However, the lag in lithium production capacity expansion meant that the deficit persisted, driving up prices.

Lithium rollercoaster

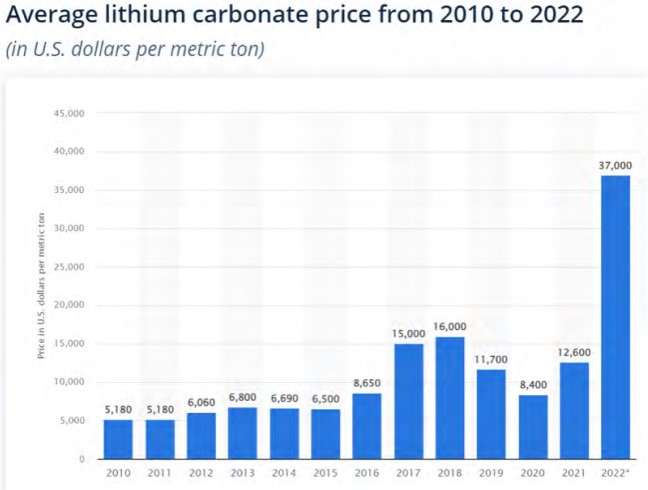

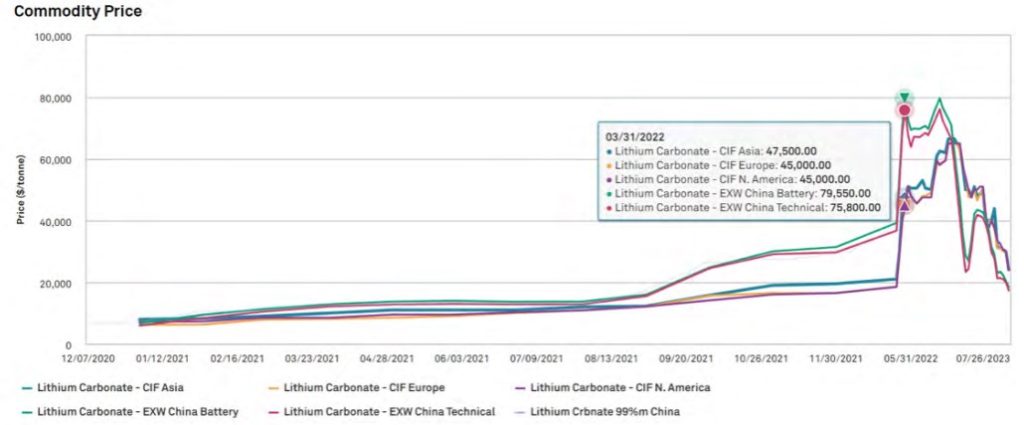

During 2022, the Chinese domestic lithium market witnessed an unprecedented price surge in the first quarter. Battery-grade lithium carbonate prices skyrocketed by 101.4% between January and March due to an expanding supply deficit.

Lithium hydroxide prices also increased, reflecting concerns about supply constraints in the comparatively smaller hydroxide chemical market.

However, throughout the first quarter, lithium carbonate maintained a price advantage due to growing demand from lithium iron phosphate (LFP) cathode manufacturers.

In the international market, the first quarter saw a substantial upward adjustment in prices for lithium chemicals supplied under contract. This was the result of a shift towards more frequent price adjustments in late 2021, as producers restructured their contracting mechanisms to align sales with market-driven pricing.

By February, international spot market prices were almost on par with domestic prices in China, which is often seen as a benchmark for international trade. This was due to the delayed effect of the Chinese price rally on sentiment outside of China.

In Europe and North America, spot market prices for small quantities of lithium hydroxide saw a sharp increase in the first quarter. This was in response to limited availability following Russia’s invasion of Ukraine, which led to severe restrictions and sanctions on Russian hydroxide volumes.

Yet, the price environment today is a long way from the highs of 2022, and followed a continued downward slide over the past year. Benchmark’s battery grade lithium carbonate, ≥99.5% Li2CO3 (EXW China), price reached US$81,375/t in December 2022. Since then, prices have fallen by 71.8% to US$22,950/t in the most recent assessment on 11 October 2023. Benchmark’s latest global weighted average lithium price is US$27,177/t. The only respite from falling prices in the interim was a mostly sentiment-driven price rally in May 2023, which pushed prices up to around US$42,000/t, but failed to last beyond July.

A downturn in EV sales in China has curtailed lithium demand from battery manufacturers during their usual restocking period. Instead, companies have capitalized on high stock levels resulting from the supply surplus, fuelled by considerable subsidies from the Chinese government in 2021 and 2022.

These factors have led major market participants to predict that the next lithium deficit will not occur until 2028. This is a significant departure from earlier predictions of continuous shortages that drove lithium prices to US$79,650/t (EXW China battery) in November 2022.

Fuelling lithium demand

Several key players dominate the lithium mining landscape. Among them, Albemarle, Sociedad Quimica y Minera (SQM), and Ganfeng Lithium stand out as major contributors to global lithium production.

Ganfeng Lithium has rapidly expanded its influence in the market through strategic partnerships and investments in mining projects worldwide. The company has 600Kt of lithium carbonate equivalent (LCE) planned for annual capacity in the future and covers a wide swath of the lithium battery supply chain; from lithium resource development, refining, and processing to battery manufacturing and recycling. The company’s products are widely used in EVs, energy storage, 3C products, chemicals, and pharmaceuticals.

Albemarle, headquartered in the US, has the capacity to produce roughly 225,000 metric tonnes of raw lithium material a year and plans to roughly triple that by 2030. The company’s Greenbushes hard rock mine in Australia produced roughly 37,000 metric tonnes of lithium concentrate in 2022. Albemarle’s conversion capacity should keep up with its mining capacity over time thanks to projects like the South Carolina mega-flex facility.

Most of Albemarle’s conversion capacity is currently located in China, but that will change over time. Along with a large US facility, Albemarle plans to put a mega-flex facility in Europe.

Over in Chile, SQM’s lithium carbonate production capacity amounted to 180,000 metric tonnes in 2022 and will be increased to 210,000 metric tonnes by the end of 2023. The company’s lithium hydroxide capacity is planned to be increased from 30,000 metric tons as of 2022 to 100,000 metric tons by the end of 2025. Based in Chile, SQM is one of the world’s largest lithium producers.

Both SQM and Albemarle operate in the Salar de Atacama, a salt flat in northern Chile, and a part of the world’s prolific lithium triangle. SQM has a contract to operate until 2030, while Albemarle’s contract is valid through 2043.

What’s to come

Looking ahead, the lithium market is poised for continued evolution. The electrification of various industries beyond automobiles, such as energy storage and portable electronics, will likely sustain demand. However, the increased focus on sustainable practices and the development of alternative battery technologies may temper the rate of growth of this demand.

BloombergNEF expects global demand for lithium to grow nearly five times by the end of the decade

Technological innovations, including the development of solid-state batteries and alternative materials for energy storage, could potentially reshape the landscape of the lithium market.

Additionally, recycling initiatives and circular economy practices are gaining momentum, offering a sustainable way to extract lithium from used batteries.

Statista estimates lithium’s market value is forecast to increase to nearly US$19B by 2030 due to its increasingly significant importance for a variety of applications, particularly lithium-ion batteries. By the end of 2023, the global market value of lithium is expected to be US$8.2B.

Similarly, Wilsons Advisory told Bloomberg that the current lithium price pullback provides a good buying opportunity for lithium stocks as demand growth over the next decade should support long-term prices. BloombergNEF expects global demand for lithium to grow nearly five times by the end of the decade.

Overall, the lithium market has undergone a dramatic transformation and is experiencing volatility. The recent deficit in lithium supply, driven by this unprecedented demand, has spurred significant investments in mining projects across the globe. As new sources of lithium continue to come online and technological advancements evolve, the market is gradually shifting from a state of scarcity to one of equilibrium.