The Australian mineral exploration sector is revelling in a buoyant period of ready access to equity funding. These joyous days for geologists contrast starkly with the five-plus year period prior to 2020 when there was minimal interest in the sector and junior explorers suffered a prolonged capital strike.

For example, in the four-year period from 2013-2016, there was a total of only 20 mining and resource IPOs on the ASX, i.e., an average of only five per annum. To mid-July in calendar 2021, there have already been over 50 resources IPOs on the ASX (including relistings of recapitalized companies)

In the 2013-2016 resource IPO drought, ASX resources IPOs managed to prise a paltry total of A$80M in equity from investors, or around $20M per annum on average (PCF Capital data). Already from January to mid-July 2021, over A$1B has been raised in ASX resources IPOs.

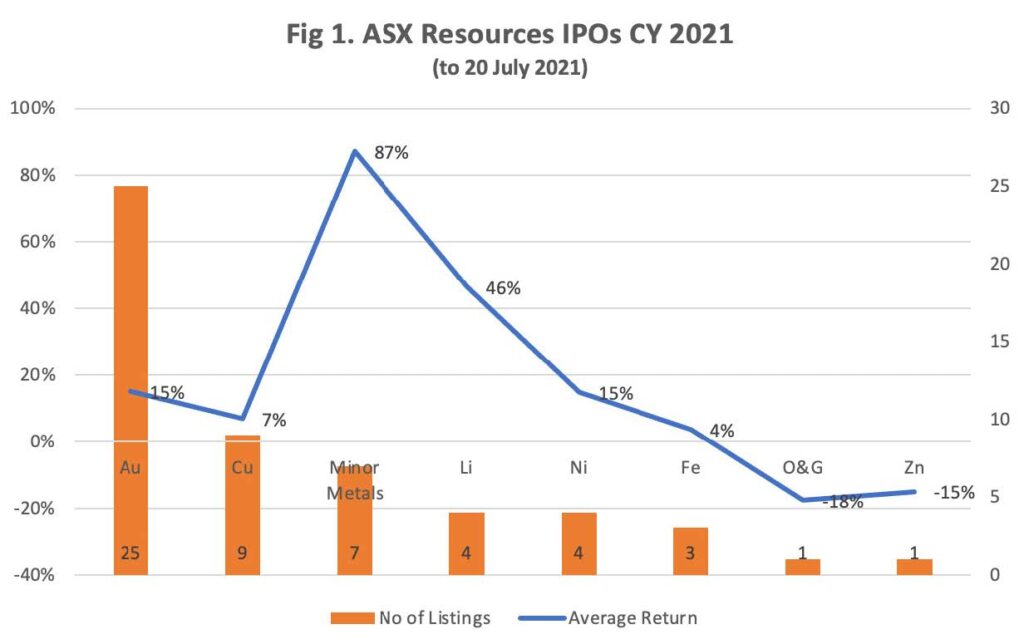

Figure 1 shows that, on average, investors in these new listings have done well. The overall average return of CY ’21 ASX resources listings is 24% (to mid-July). The best commodities to have taken an IPO punt on have been minor metals (manganese, kaolin, PGM, REE, silica and uranium), up 87% on average.

Next best have been lithium listings, up an average of 46%.

Gold, nickel and copper floats have also performed creditably, with new gold and nickel companies up 15% and copper 7%. The best performing listing (actually a recapitalization after suspension) has been Odyssey Gold (ASX: ODY) up over 300% after drilling a vein of solid gold.

Somewhat surprisingly, given the price of the commodities, the laggards have been oil & gas and zinc, albeit from an IPO cohort of only one each.

In terms of total capital raised (i.e., equity issued by existing listed companies as well as new IPOs), Austex Mining Pty Ltd reported that in Q1 2021 there was A$2,149M subscribed in ASX-listed exploration company equity raisings. This represents more than a fivefold increase compared to the same period five years earlier in Q1 2016 at the depths of the “capital drought”, and is also up more than four times on the more recent equivalent periods in 2019 and 2020.

Which metals are being targeted?

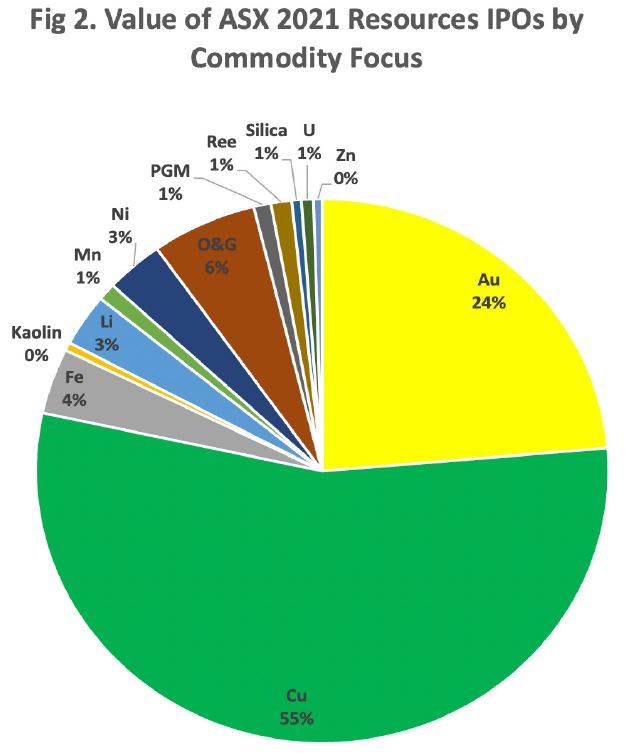

Figure 2 shows the value of 2021 ASX resources IPOs by their commodity focus. Copper has garnered the largest share of IPO funding, dominated by the $527M listing of EMR-backed 29Metals (ASX: 29M), which also produces zinc and gold. That outsize IPO aside, the focus of the majority of ASX-listed exploration companies is still firmly on gold.

In Q1 2021, 48% of exploration company expenditure was dedicated to gold exploration, followed by oil & gas with around 15% and copper approximately 10%. Nickel/PGM, lithium and lead-zinc were all less than 10%.

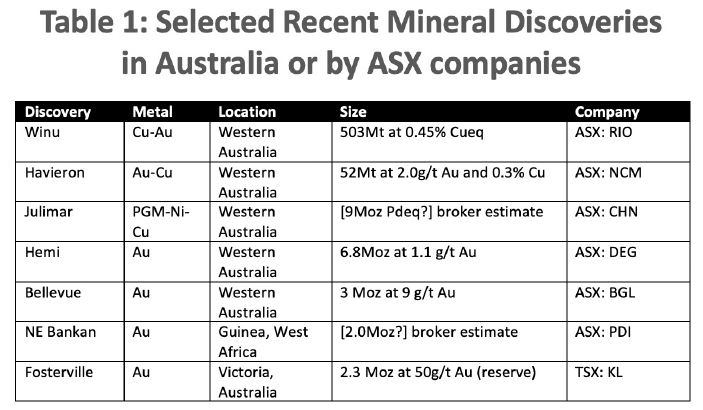

What is being discovered, and where?

Are there more discoveries being made?

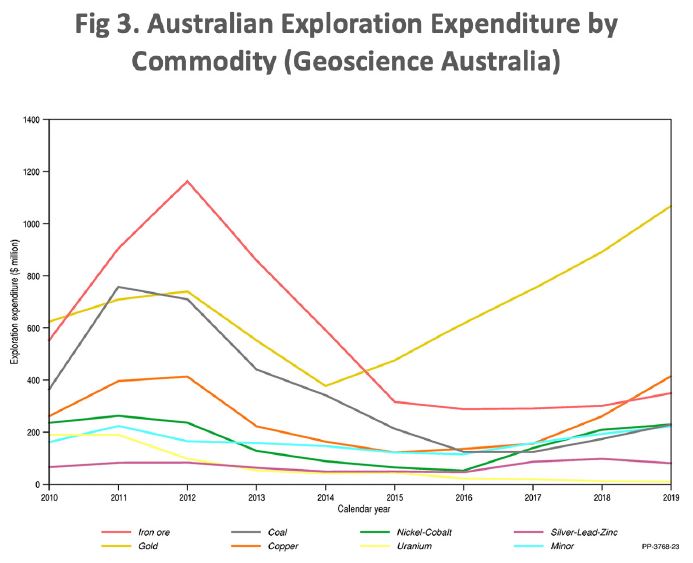

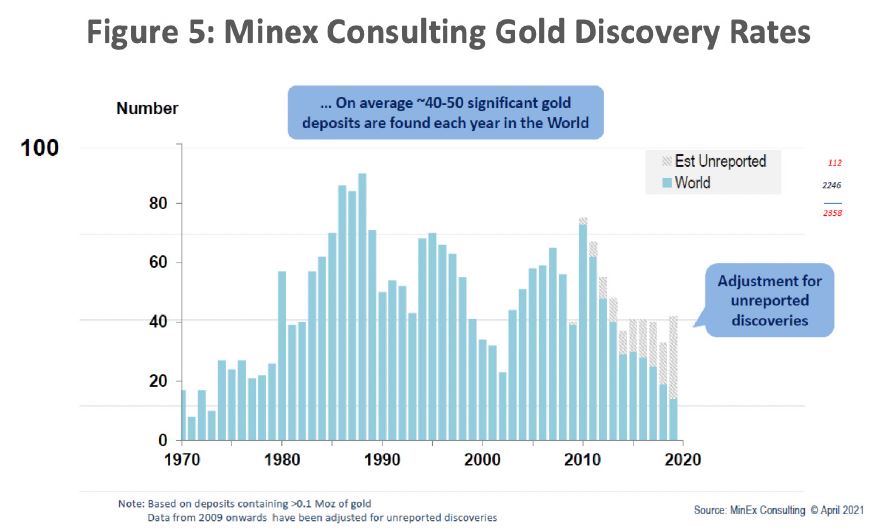

With Australian exploration expenditure up almost 100% from five years ago, we should expect a higher discovery rate. Data on discovery rates capturing the most recent uptick in exploration expenditure is not available, but Minex Consulting reports flat to falling discovery rates for gold in the 2010-20 decade, i.e., after the 2000s mining boom (Figure 5.). However, 2018 may have seen the low point for global gold discovery rates, if exploration expenditure increases correlate to discovery rates – “the more you drill, the more you find”!

Of note is the salient truth that rising metal prices not only assist the ability of companies to raise and allocate money towards exploration but, all other things being equal, higher prices “lower the bar” for the definition of what may be classed as an economic discovery. For example, at $500/oz gold price, a thick but deep gold drill intersection grading, say, 2g/t Au would be unlikely to be considered economic, but at $2,000/oz that same intersection may be classed as a discovery which gets brokers on their mobiles to their clients.

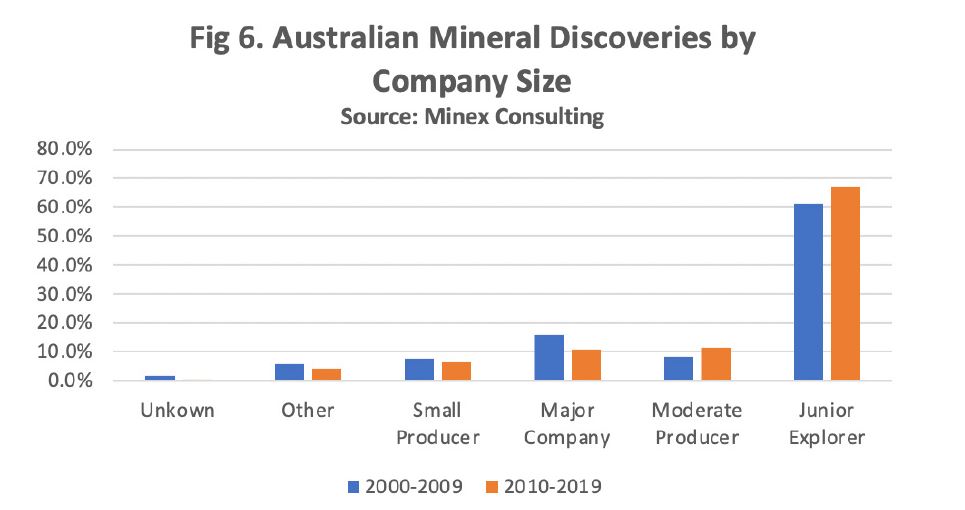

Which Companies are making the discoveries?

Junior explorers are, by a long margin, the generators of the vast majority of Australian mineral discoveries. And their share of the discovery pie is only increasing (Figure 6). This is partly because of the sheer number of juniors versus majors, but also may reflect a trend in the reduction in exploration budgets by large companies.

Of course, a mineral discovery has a disproportionately large impact on junior companies compared to a major. For example, the market capitalization of De Grey Mining (ASX: DEG) in late 2019 prior to its discovery of the Hemi deposit was around A$50m. Today it is in the order of A$1.5bn. By contrast, Rio Tinto’s share price has risen around 50% since announcing the Winu discovery in early 2019, but most of that rise should be attributed to the iron ore price.

Conclusion: The Age of the Junior Explorer

The junior exploration sector is experiencing a funding boom. Given the juniors’ large and apparently growing share of Australian mineral discoveries by number, we look forward to an accelerating frequency of discovery announcements from the sector – and, indeed, skyrocketing share prices to

match!