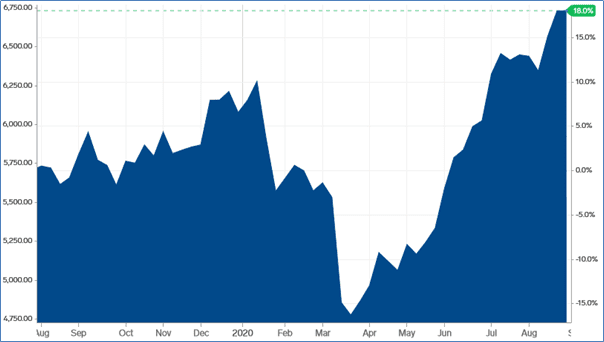

Copper has well and truly recovered from its COVID-related price scare during March. China has been doing the heavy lifting in terms of demand recovery, incentivized through Government stimulus. There are strong parallels now to the extremely strong post-GFC environment that saw copper prices outperform.

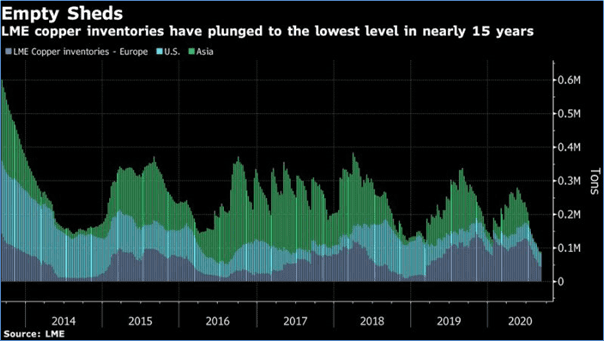

Bloomberg has highlighted the fact that “the global copper market could be on the cusp of a historic supply squeeze as Chinese demand runs red hot and exchange inventories plunge to their lowest levels in more than a decade.”

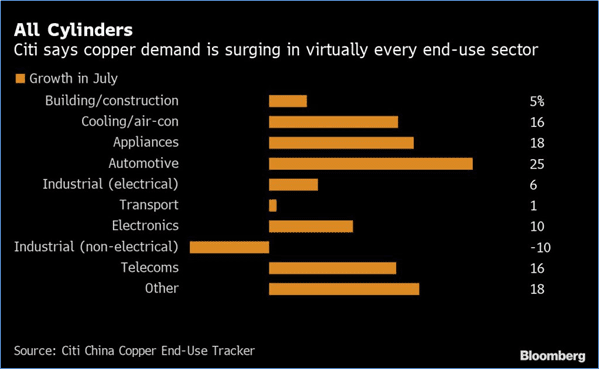

The 24 million ton-per-year copper market has experienced bouts of tightness ever since the early days of China’s industrial expansion, but China’s rampant appetite after emerging from coronavirus lockdown could be ushering in a period of chronic undersupply. As evidence, China’s Caixin manufacturing purchasing managers’ index for August reached its highest reading since January 2011, with copper usage surging.

Citigroup is highly bullish on copper, arguing that a price of $8,000 is plausible if global stockpiles drop to near the levels seen in 2011, when copper reached a record $10,190 a ton.

Evidence of a looming supply squeeze is mounting on the London Metal Exchange, where inventories are at their lowest levels in almost 15 years – only enough to last users a little more than a day. By comparison, a year ago they would have lasted five.

In the past, copper stored elsewhere in the global supply chain was diverted to the exchange’s storage depots. But now there are signs the metal may not flow back to the bourse so freely, given the strength of Chinese demand.

LME data shows there were about 120,000 tons of copper stored privately in Europe at the end of June, but none has materialized on the exchange, even with the region’s lackluster economic recovery. At the same time, the LME’s Asian depots are virtually empty. There are about 80,000 tons in Comex depots in the U.S., but manufacturing in the world’s top economy also is starting to snap back strongly.

Consumers and traders may be more reluctant to offload excess inventories out of fear that a fresh wave of coronavirus infections could reimpose havoc on supply chains. Trafigura, the world’s top copper trader, commented in June that the desire to bolster reserves of raw materials was one factor driving the rapid rebound in orders as China emerged from lockdown.

With investment in copper-intensive sectors such as renewable energy and electric vehicles set to swell as countries start rebuilding their economies, manufacturers in previously weak markets like Europe also may look to boost their inventories, creating an additional draw on spot supplies.

And while specialist commodities funds are turning bullish on copper’s tight fundamentals, long-term macro investors are starting to take a more favorable view of the metal as an asset that should hold up against a falling dollar and rising inflation – potentially providing further price support.

A new report from Roskill says while the effects of COVID-19 could decrease world consumption of the metal by between 3% and 4% this year, the drop in mine output and scrap flows has been greater.

The lack of available scrap – imports are down 50% during H1 2020 after Beijing delayed new importing rules – has forced Chinese buyers to replace secondary sources with a cathode, further driving down visible inventories.

Roskill estimates a roughly 300,000-tonne shortfall in imports of secondary materials – scrap, ingots, and granules – into China from January to July, and that scrap flows might not normalize until the first quarter of next year.

Furthermore, disruptions to mine supply could be between 750,000 to 1 million tonnes in 2020, with eight out of the 10 largest miners recording lower output during the first half of the year. China’s concentrate imports are down year on year while sourcing anodes and blister from the central Africa copper belt is also hitting roadblocks.

From a historical perspective too, there is strong grounds for further price appreciation. The current environment has strong parallels to the rebound in the copper price in the wake of the global financial crisis. Copper hit a low of $1.32 a pound in January 2009, then surged to $3.55 by April 2010 on its way to an all-time peak of $4.58 (more than $10,000 per tonne) during February 2011.

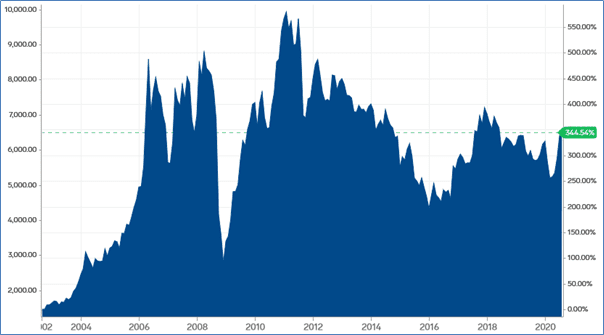

Another important factor that is likely to help support copper prices, and the commodity complex generally, is the performance of the US dollar. At the recent virtual Jackson Hole Fed gathering, Chairman Jerome Powell told the world the US central bank is prepared to allow inflation to average 2%, rather than using the level as a target. The tolerance for a rise in the inflation rate above the 2% level is a boost for commodity prices, at the same time as the trend in the US dollar looks weak.

The US dollar index reached an 18-year high in March when it rose to 103.96 as risk-off conditions gripped markets, sending money flows into safe-haven assets. Since then however, it has been all downhill for the US currency, which broke through a support level in July. The long-term performance of the US dollar index can be seen in the graphic below.

The bottom-line is that a higher tolerance for inflation is a bearish factor for the value of the US dollar against other currencies. With commodities typically moving inversely to the US dollar, as they become cheaper to buy in terms of other currencies, copper is set to be one of the biggest beneficiaries.

From a price perspective, my rule of thumb is that a price above $3.00 a pound is necessary to incentivize new production in order to satisfy growing global usage for the copper. We are all very much aware of the growing demand that will come from the EV and energy storage sectors, so the long-term demand-supply picture is supportive of higher copper prices.