China’s strength in acquiring and producing commodities is growing. With the emergence of stringent foreign investment policies in Western markets, the Chinese government is storming ahead to attain more and more materials which are vital to the green energy transition, such as lithium.

In the wake of growing domesticated supply chains and increasingly restricted foreign market policies, China is set to continue to build its influence over these energy-transition materials and the industries that rely on them.

Besides the Chinese Government, a multitude of Chinese companies, manufacturers, EV, and battery makers are entering the competition to attain as much of the green energy pie as possible.

Although many countries are increasingly aware of these minerals’ importance, Chinese firms have been the most active in these activities. China is looking at acquisitions across Africa and Latin America, according [KG1] to S&P Global. While these ventures may bring benefits, they may also raise investment and execution risks for related sectors, as more firms enter these new markets.

S&P Global reported that since 2018, China has been the catalyst behind all major lithium M&A deals over US$100M. Chinese firms bought 10 of the 20 lithium mines available, for an estimated US$7.9B, while Australian companies came a distant second, obtaining just five mines over the past five years, according to a survey of deals worth more than US$100M.

Half of those mines are in Canada and Australia, whilst others – in line with S&P Capital’s forecast, are in Argentina, the DRC, and Zimbabwe.

Australia

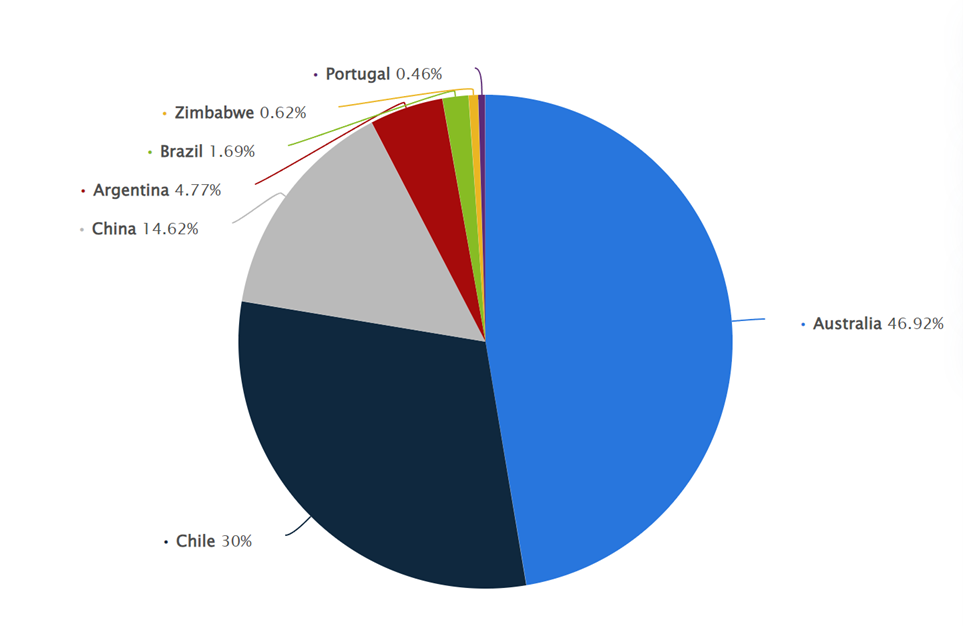

According to Statstia, Australia is dominant in lithium mining, producing 47% of global lithium supplies in 2022. But it exports 90% of its output to be refined in China, which continues to lead global lithium processing and accounts for about 60% of globally refined supplies.

The S&P Report shows that Chinese investors have not bought a mine in Australia exceeding US$100M since 2021, with the last purchases being AVZ Minerals and Balmoral Iron Pty Ltd. Chinese investment into Australia is facing more scrutiny from regulators, amid growing calls for more domesticated supply chains.

Australian Treasurer Jim Chalmers blocked three attempts by Chinese miners to buy projects in 2023, including barring the takeover of financially stricken lithium miner Alita Resources by a China-linked company on advice from the FIRB in July.

The Australian Treasurer is the ultimate decisionmaker in relation to foreign investment applications, but generally acts on the Foreign Investment Review Board (FIRB) advice. In another rare instance of a rejection being made public, in February, Chalmers intervened to stop China’s Yuxiao Fund increasing its stake in rare earths miner Northern Minerals from 10% to 19.9% based on advice from the FIRB. Chalmers did not provide a reason for his decision.

Despite this, China remains a dominant investor into the Australian economy, ranking number 10 in 2022, according to the Australian Department of Foreign Affairs and Trade.

Latin America

According to The Foreign Affairs Committee From 2018 to 2020, China invested US$16B in overseas mining, including investing in South America’s “lithium triangle”, the region consisting of parts of Argentina, Bolivia, and Chile. These countries account for 56% of the world’s lithium resources.

The People’s Republic of China is thelargest investor in Peru’s mining sector, controlling seven of Peru’s largest mines, 100% of Peru’s iron production, and 25% of their copper output.

The PRC also owns two of the five largest copper mines in Peru – the Las Bambas Project, which produced an estimated 263Kt of copper in 2020, and the Toromocho Project, which produced an estimated 190Kt of copper in 2020. Both projects are set to operate until 2038 and 2056, respectively.

As of 2022, Chinese based Tianqui Lithium Corp. is the second largest shareholder in Chilean lithium miner SQM, the world-leading bring-based lithium producer, with a total of 25.9% shares.

Zimbabwe

According to Reuters, Chinese-owned companies have spent more than US$1B acquiring and developing lithium projects in Zimbabwe.

The article explains that this year, Chinese minerals mega-company Zhejiang Huayou Cobalt opened a lithium processing plant, costing US$300M at its Arcadia mine, which it purchased the previous year from Prospect Resources for A$422M.

The plant presently has the scope to process around 450,000 metric tons of lithium concentrate annually. Under Zimbabwean law the refined lithium can then be exported for further processing into battery-grade lithium offshore.

In May, another Chinese company, Chengxin Lithium Group, commissioned a lithium concentrator to produce 300,000 metric tons per year at the Sabi Star mine in eastern Zimbabwe. And China’s Sinomine Resource Group said last month it had completed a US$300M lithium plant, after it bought Bikita Minerals, one of Africa’s oldest lithium mines, for US$180M.

It’s clear to see that China is steaming ahead in the race to secure lithium supply chains, the mega-country has seized the opportunity to invest in both areas of high demand and areas where western investments have yet to catch up. As supplies are becoming increasingly more domesticated, it remains to be seen if China can continue its upward trajectory.