The recent break in the bond market through critical levels of technical support, selling in stocks, and a lethargic US dollar, could be signalling that inflation is coming back with a vengeance. If we are indeed on the verge of an inflationary spike, commodities will likely be the asset class that performs best. Commodities prices tend to be barometers of inflationary pressure.

Before we examine this in more detail, it’s fair to say that one of the biggest support factors for the commodity sector overall since the beginning of 2017 has been the weakening trend in the US dollar. In 2017, the dollar supported commodities prices.

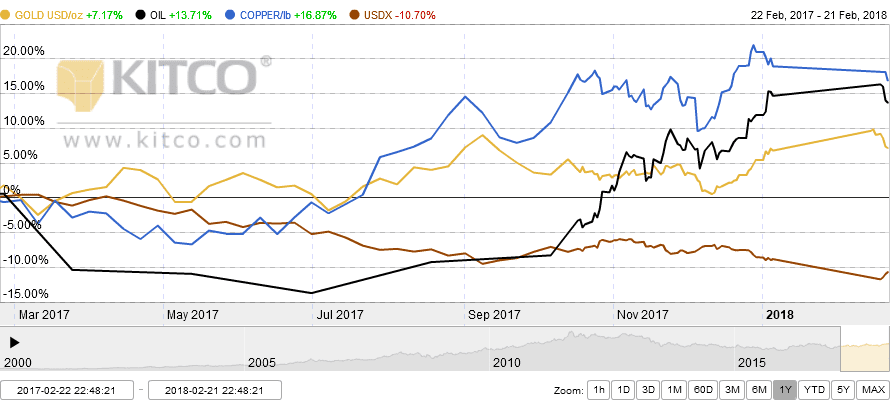

Commodities prices have moved higher as an asset class since reaching lows during late 2015/early 2016. Over the past 12 months we have seen key raw material prices trend to the upside – including copper, oil and gold. By contrast, the US dollar has declined. This is clearly represented in the graphic below, which compares their relative performance.[/vc_column_text][/vc_column][/vc_row]

Interestingly, coincident with the US dollar’s most recent low, we correspondingly saw crude oil traded at its high at $66 a barrel and gold move to the $1370 per oz level. Whilst the US dollar began 2017 in strong fashion, the greenback reversed and spent the rest of the year moving to the downside. Not even three interest rate hikes by the Fed could arrest the US currency’s decline.

As the dollar has headed lower, many raw material prices – both industrial and agricultural – have moved higher. This reinforces the connection between the value of the US dollar and commodity price movements.

But another important support factor for commodity prices is also at play. Commodities markets are increasingly being influenced by developments in interest rate markets. The recent decline in the bond market that triggered panic selling of equities, also temporarily lifted the dollar, whilst leading to a retracement in commodities prices.

It’s true that lower bonds and higher interest rates tend to lead to an increase in the cost of carrying inventories, which often leads industrial consumers to sell off stockpiles and purchase requirements on a hand-to-mouth basis. Higher rates also increase the cost of carrying a speculative long position, which often deters buying in many raw material markets. Higher real interest rates tend to have a bearish impact on commodities prices.

However, what we’re seeing now is somewhat different. Sometimes bonds fall and rates rise because of inflationary pressures, which can have the opposite effect on raw material prices – effectively pushing them higher. This is the situation I believe we’re in now. It’s commonly acknowledged that inflation eats away at the value of money, so when interest rates rise – so do commodities.

While the memories of the global financial crisis of 2008 have faded somewhat, the tools central banks used to fight off potential economic disaster in the years that followed will inevitably take their toll. This included money printing and the slashing of interest rates by the US Fed, ECB and other central banks around the world to historically low levels. In the US, rates fell to zero percent, whilst in Europe and Japan short-term rates fell into negative territory.

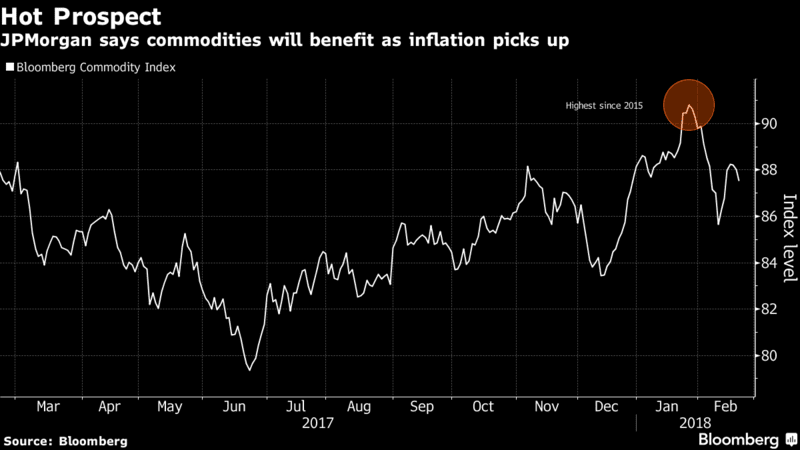

The long-term impacts of these central bank actions are likely to be an inflationary backlash, which would create a highly bullish environment for the prices of commodities. If we are on the verge of an inflationary spike, commodities will likely be the asset class that does the best. Few assets benefit from rising inflation, particularly unexpected inflation, but commodities usually do. Because commodities prices usually rise when inflation is accelerating, they therefore offer protection from the effects of inflation.

Our view is supported by major groups including JPMorgan. In an interview with Bloomberg this week, they noted that “Rising inflation is beneficial for commodities. In fact, metals, both base and precious, exhibit their best performance (both outright and volatility-adjusted) when inflation has reached the Fed’s 2 percent target and continues rising.”

Glencore also touched upon the outlook for “emerging inflation” as a positive for commodities as it reported record earnings this week. In its report, Glencore said “the potential of synchronized global economic growth, emerging inflation, supportive commodity fundamentals and the emerging electric-vehicle story suggest a positive outlook for commodities.”

Summary

The recent break in the bond market through critical levels of technical support, selling in stocks, and a lethargic dollar, is likely signalling that inflation is coming back with a vengeance. Commodities prices tend to be barometers of inflationary pressure, so should therefore benefit strongly.