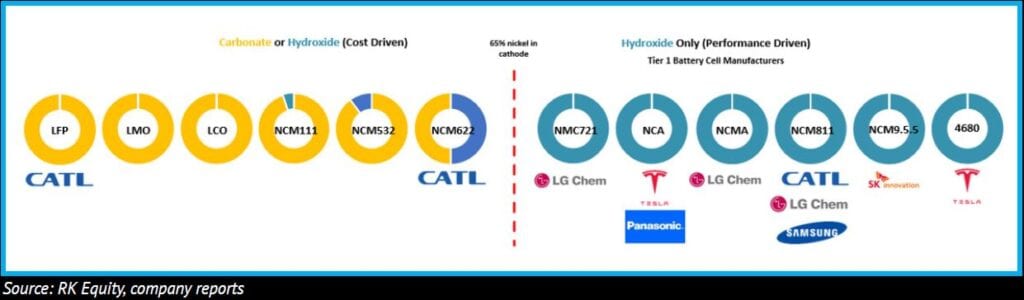

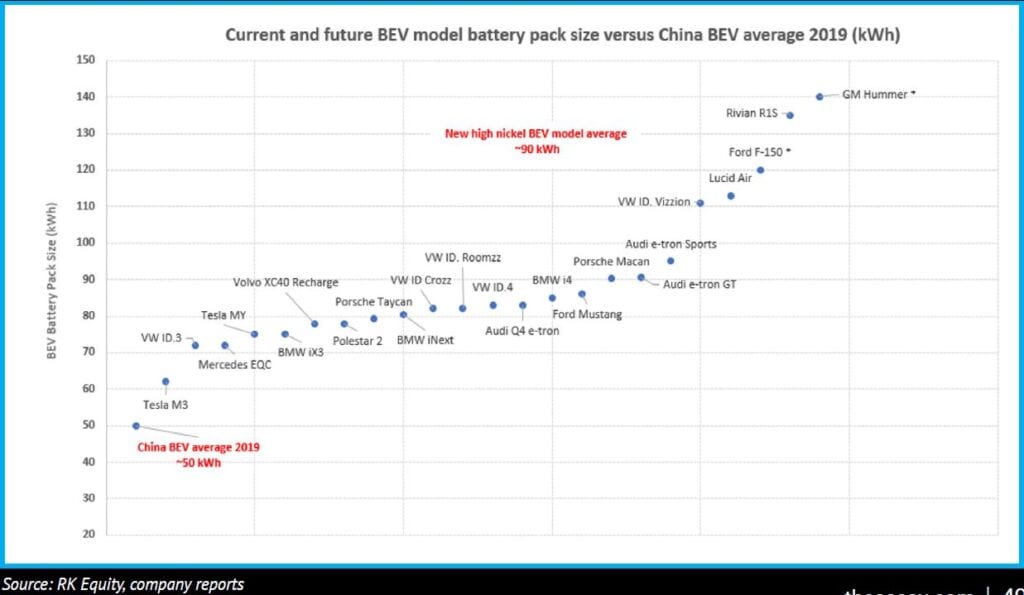

After EV sales disappointments in 2019 and early 2020, the market for plug-in vehicles is finally showing signs of strong growth, particularly in Europe where generous buyer subsidies and CO2 emission penalties are having the desired effect. Globally, EV sales are likely to finish 2020 with a ~3.5% market share. Analyst forecasts for 2030 range between 30% and 50%. The vast majority of future zero-emission vehicles will use lithium-ion batteries. The irreplaceable element in a lithium-ion battery is, of course, lithium. As charging infrastructures will take time to roll out, customers (excluding those in China) favour long-range EVs with fast-charging capabilities. At the forefront of EV sales is Tesla who, up until now, has used high-nickel cells supplied by Panasonic. For their new EV launches, the Cybertruck and the Semi, Tesla will continue to use high-nickel cathode variants given the range sensitivity to pack weight and energy density. Other Western EV models are typically compared to Tesla on a battery pack size/range basis resulting in an EV market fixated on energy density and range. As shown in the graphic below, all of the tier 1 cell manufacturers are focusing on high nickel (>65%) cathodes – cathodes that can only use battery-quality lithium hydroxide.

The market for battery-quality lithium hydroxide was small before 2019 as China’s EV sales dominated the market (using the low-nickel cathode variants as shown on the left of the graphic above). The EV markets in Europe, America, and the rest of world are now larger than China’s and growing rapidly (using the high-nickel cathode variants as shown on the right). Beyond the basic sales numbers, the average battery pack size (~90 kWh) of new EVs launching outside China are larger than those used in China (~50 kWh). The combined effect of the shift to high-nickel cathodes and the increase in the average battery pack size is a substantial rise in the demand for battery-quality hydroxide.

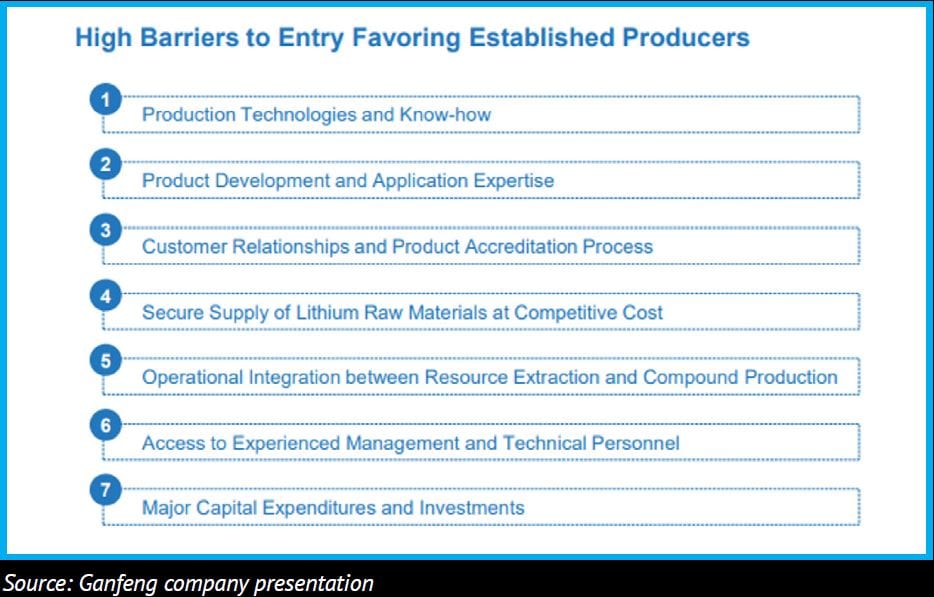

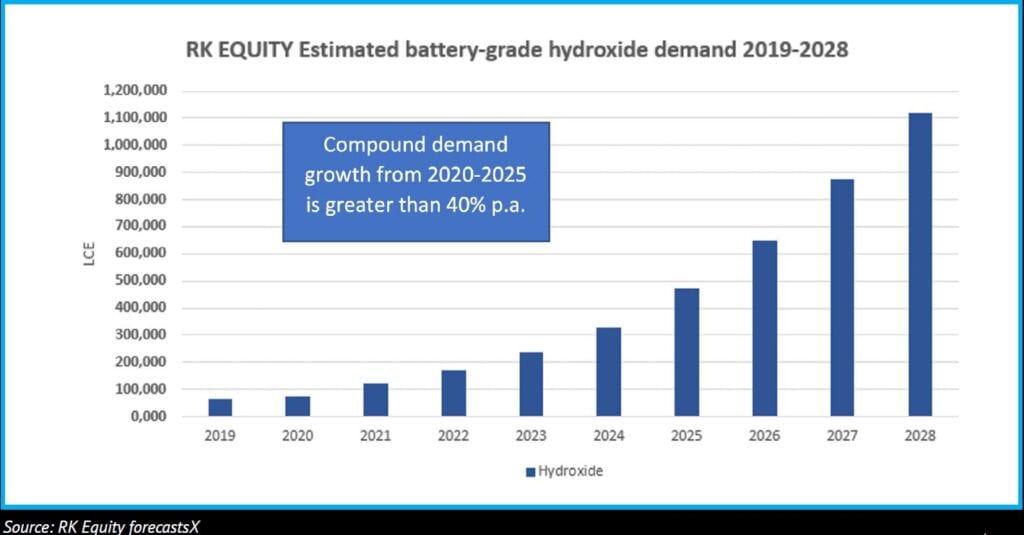

In 2020, RK Equity estimates that the global market for battery-quality hydroxide will be approximately 77KT LCE. In 2021, Ganfeng, the world’s number one hydroxide producer, will see demand growth of 50-60KT LCE – in line with RK Equity’s estimates. That’s a year-on-year growth of ~65%-78% for a very specialised chemical with only three major suppliers qualified into the battery supply chain. Entering the battery-quality hydroxide market is no easy feat, as indicated by the barriers listed in the graphic above.

Of the three major suppliers, two (Albemarle and Livent) have recently stated that they will keep production flat in 2021. Only Ganfeng will increase production through its newly commissioned hydroxide plant in China. According to Ganfeng, they believe battery-quality hydroxide supply will increase by 30KT LCE (RK Equity 36KT LCE) in 2021. Tier 2 suppliers will face the entry barriers outlined above. In addition, Albemarle will no longer use third-party tollers to ensure the security of its IP.

Why would two of three major suppliers keep production flat when demand is growing by ~70%?

The answer is: the price. Demand for EVs is rising, but OEM battery profitability is not. As OEMs transition sales from internal combustion engines (ICEs) to EVs, operating margins are under pressure. On a look-through basis, raw material costs, particularly nickel and lithium hydroxide, represent the highest input costs for battery cathode/cells. Procuring readily available raw materials for ICE vehicles allows for price discounts when ordering larger volumes. This business model does not apply to key EV cathode raw materials, particularly lithium hydroxide. Future demand for battery-quality hydroxide is substantial. For existing producers, the incentive price (15%+ after-tax internal rate of return) to expand chemical production outside of China is USD 12,000/t or more. Exports from China already represent more than 80% of world supply.

If battery cell plants in Europe, the US, and Asia (excluding China) are looking to transition to lower carbon regional supply chains for raw materials, then there is no avoiding the minimum incentive price of USD 12,000/t. Recent earnings reports from incumbent producers have highlighted a harsh reality; low chemical prices translate into low operating margins/free cash flows and the ability for producers to expand production capacity to service future demand needs. In our opinion, Albemarle and Livent are sending a clear message – they will constrain production and delay capacity expansions until incentive prices are reached (preferably through long-term contracts). Ganfeng’s production expansion capabilities are limited to their access to “integrated” low-cost raw material supply from the 50%-owned Mt Marion mine. Further expansion will be dependent on the availability and price of non-integrated spodumene concentrate supply from Australia.

The market for battery-quality hydroxide is going to move from a marginally oversupplied position in 2020 to undersupplied in 2021 and beyond. In the absence of a transparent futures market, buyers and sellers won’t know the true extent of the shortfall. Short-term, the OEM/battery cell companies may score a “win” by negotiating slightly lower contract prices for 2021; we see this as playing checkers. According to our estimates, by mid-2021 additional demand needs beyond contract volumes will drive prices higher. The qualification process into OEM supply chains is lengthy and future capacity expansions are limited. Even higher prices will not translate into an immediate supply increase. To meet 2025 demand needs, initiatives like the European Raw Material Alliance, with its ambitions to source 80% of lithium needs regionally, are running out of time already. Western OEMs face substantial CO2 emission penalties for non-compliance. Will it be more expensive to run out of battery supplies and pay the CO2 penalties or to pay an extra ~USD 1.60/kWh (USD 12/kg versus USD 10/kg x 0.8 kgs) to ensure the security of battery-quality hydroxide supply? RK Equity believes the former is the most costly route as the penalty for selling an ICE vehicle instead of an EV is approximately EUR 9,000 per car above the CO2 fleet cutoff limit (approximately 95 gCO2/km). By comparison, the extra cost to secure hydroxide would be about EUR 60 per vehicle. For now, US-based OEMs are facing limited penalties in specific states, but what if the whole of the US auto market faced similar CO2 emission penalties? Competition for battery raw materials would intensify dramatically.

Eventually, the superior all-in cost economics of EVs (2024 onwards) will ensure their adoption, which means competition for raw materials is inevitable – it’s simply a matter of when, not if. Given there is a step change to more stringent CO2 emission standards in Europe in 2025 and 2030, Western OEMs need to start playing chess to avoid disaster. Initiatives like battery recycling and selling smaller battery hybrids come with their own set of limitations. If most major auto markets are looking to ban the sale of new petrol and diesel ICE vehicles by 2030 and hybrids by 2035, customers are likely to shift their buying patterns well ahead of those deadlines.

At RK Equity, our focus is on the fast-growing European and North American battery supply chains. Companies that can supply low cost/low carbon footprint products (lithium, nickel, graphite and manganese) into those supply chains from immediate or nearby safe jurisdictions will be the major beneficiaries of the inevitable evolution of OEM supply chain business models to secure, clean localised supply.