The essential steel-making ingredient that burst out of the blocks with the onset of the China boom during the early 2000s, has defied the sceptics and generated an earnings bonanza for the mining heavyweights that dominate the industry. Iron ore is the gift that keeps on giving as far as Australian iron ore miners are concerned, with federal treasury officials cheering from the sidelines.

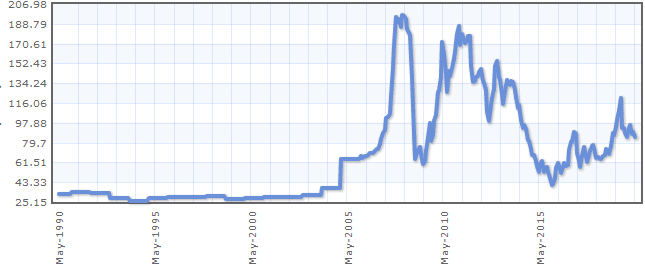

The graphic below highlights the volatility in iron ore prices since 2004, compared to the preceding decades. Due to the dynamics of the iron ore industry, it has historically been dominated by mining industry behemoths. The steel-making ingredient had typically been a large-capex, low-margin business – thus spawning significant barriers to entry for smaller/mid-cap miners.

Big miners have therefore become the key suppliers, possessing the large balance sheets that can fund large-scale iron ore developments. Finding an economic deposit is just the start – as developments typically require the construction of key infrastructure such as railways and ports – to enable the ore to be transported from mine-site to international customers.

With iron ore prices typically trading below US$30 per tonne for many decades leading up to the 2000s, the industry was a low-margin affair, where miners would generate returns over the medium to longer-term on their initial investments.

Of course, all of this changed with the onset of the China boom, with iron ore prices skyrocketing towards US$200 per tonne. The incumbent iron ore industry players were caught short by China’s burgeoning demand, forcing them to play catch-up in terms of supply. Given the significant infrastructure challenges in the iron industry, it wasn’t easy for miners to turn the supply tap on quickly. Hence, rampant demand met restricted supply – leading to rapid price escalation. Australian producers have also enjoyed a logistical advantage over their Brazilian rivals, with 12 days sailing time to China compared to around 45 days from Brazil.

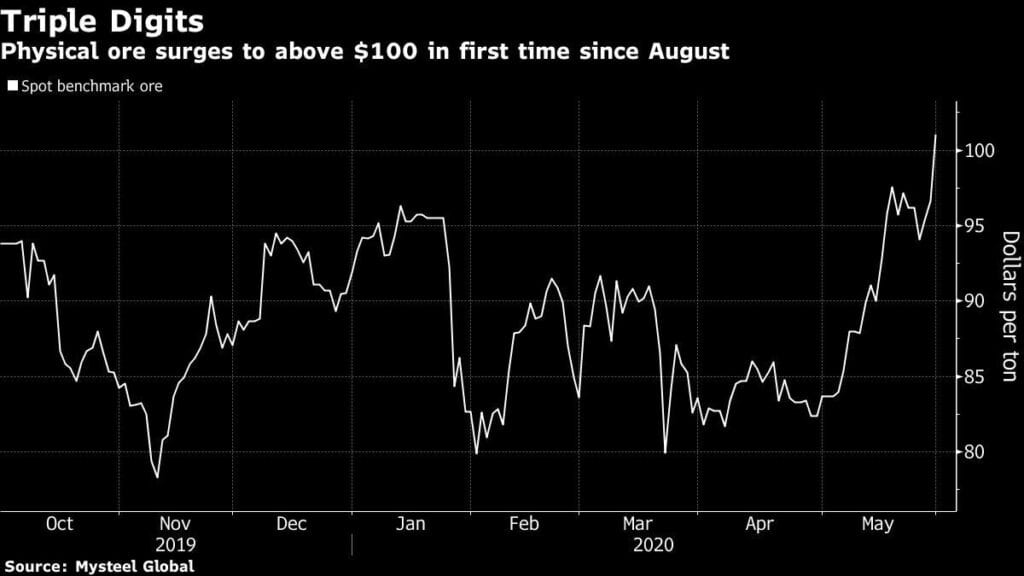

Whilst such lofty price levels were sustainable due to supply eventually catching up with demand, the pricing scenario that we witness today is still highly advantageous for iron ore miners. At a current spot price of around US$100 per tonne, prices are well above the US$30 per tonne long-term average that the industry endured for many decades.

This means that iron ore miners are continuing to generate strong operating margins (the differential between the per-tonne price received and the per-tonne cost of production). Miners have also benefitted from driving down their internal costs of production through greater economies of scale as production has grown, together with enhanced operating efficiencies. Although producers are often reluctant to provide their individual mining costs, the heavyweight miners like BHP, Rio Tinto, Fortescue Metals and Vale are all producing at a cost of less than US$20 a tonne.

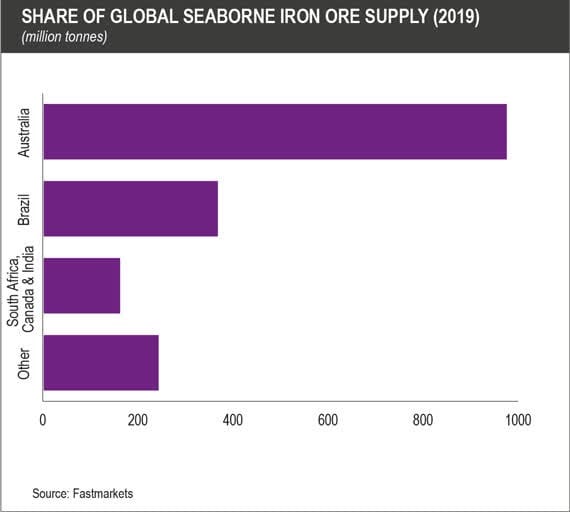

With this in mind, let’s now turn our attention to the latest industry factors that have led to a price resurgence. Last year, Australia led worldwide iron ore production with 930 million tonnes, followed by Brazil with 480 million tonnes and prices averaging US$112 per tonne, up 21% from the US$93 per tonne average during 2018. The demand-side is therefore heavy reliant on the world’s two major producing nations – Australia and Brazil – implying any supply hiccup could likely lead to a price spike. This is clearly reflected in the graphic below.

What we’ve witnessed during the course of 2020 is the market’s dependence on its key suppliers, leading to iron ore’s status as close to the best-performing commodity. As China, which buys about two-thirds of global seaborne iron ore supplies, has sought to ramp-up industrial production via government stimulus in order to boost domestic economic growth in the wake of COVID-19, the nation’s access to iron ore has been hamstrung by lower levels of output from Brazil, the world’s number two supplier.

Legacy issues from tailings dam failures have impacted Vale’s iron ore production capabilities, combined with escalating COVID-19 infections in the world’s second-most affected country. The consequence of all of this is that iron ore prices have firmed by 7% since the end of last year, due to a combination of bullish supply and demand considerations. The big question now is how long can high prices last?

The immediate outlook remains positive, as there is evidence of slower Brazilian exports. Vessel-tracking and port data compiled by Refinitiv points to iron ore shipments of about 20.8 million tonnes during May, which represents a 28.5% fall from the 29.1 million tonnes shipped during the same month in 2019. Vale had already previously indicated a trimming of their 2020 production outlook from 340-355 million tonnes to 310-335 million tonnes on account of coronavirus disruptions.

Based on the latest development however (Vale estimates a disruption of 2.7 million tonnes per month), we could now likely see 10% of Vale’s iron ore output or 2% of the total global seaborne output come to a standstill, compounding the issue in what is already a tight market.

Simultaneously, China has maintained a robust level of demand growth, with the world’s biggest steel producer registering 445.31 million tonnes of iron ore imports for the first five months of 2020, up 5.1% on the same period in 2019, according to Chinese customs data. At the same time, China’s iron ore stockpiles at its ports fell to 109.5 million tonnes as of May 29, the lowest level since November 2016, according to SteelHome consultancy.

In terms of the world demand picture, the World Steel Association estimates that global steel demand will fall by 6.4% this year, but bounce back next year. The impact of the virus has been uneven, with steel demand in China expected to rise 1% this year, while tumbling by 17% in developed economies. After a fall this year to 1.65 billion tonnes, it forecasts a rebound in steel demand of 3.8% in 2021 to 1.72 billion tonnes.

The current dynamics therefore help explain why iron ore is a standout commodity, and it’s likely that the outperformance will continue until Brazil supplies are assured, or until there is evidence of slowing Chinese steel demand.

The country that has most benefitted from the supply-side disruptions in Brazil and the demand-side push from China has been Australia, which is also the world’s largest exporter of iron ore. China currently accounts for two-thirds of the world’s iron ore demand and Australia is currently supplying between 60% and 70% of China’s total iron ore imports.

Last year, China imported around $61 billion of iron ore from Australia, and this year Australian treasury officials forecast that this could grow to $81.5 billion, representing year-on-year growth of 33%. Iron ore has also played a major role in Australia’s enhanced forecasts for overall resources and energy export earnings for 2019–20, with the government’s latest March outlook data suggesting earning of A$299 billion, up A$18 billion compared to its December outlook.

Conclusion

The iron ore industry is rather unique, in that the demand-supply elements differ from most other commodities. There are very few commodities where China dominates market demand quite like iron ore, and on the supply side there are few commodities where production is dominated by a relatively few major players. When one combines these elements, it creates the potential for both price volatility, but also extended periods of price outperformance. Australia is set to maintain its position of dominance in the iron ore business, as China has no meaningful alternative sources of supply, given ongoing supply problems from Brazil.