The metals and mining industry has long been a focus for governments, NGOs, industry bodies and wider society concerned by the environmental and social impacts of the extractive sectors. Over recent years, these concerns have led to the introduction of wide-reaching and robust ESG-focused regulations, codes and principles that mining companies are now obliged and expected to observe, requiring enhanced reporting, the introduction of best practice and procedures and, increasingly, the need to demonstrate that ESG considerations are factored into strategic decision-making. At the same time, institutional and other large investors are taking a greater interest in a company’s ESG performance and taking this into account in their investment decisions, in some cases actively excluding from their investment portfolios mining and other extractive companies that do not live up to ESG expectations. This article gives an overview of certain key considerations for miners with respect to ESG compliance and discusses some practical steps to help companies manage their ESG risks.

What is ESG?

ESG encompasses a broad range of topics, including:

- Environment: climate change, sustainability, biodiversity, waste, water and resource use, pollution

- Social: human rights, labour practices, safety, health, community, diversity

- Governance: corporate governance, ethics, stakeholder engagement, accountability, compliance and reporting, executive pay, diversity, lobbying, approach to taxation

Why the Heightened Focus on ESG?

The increasing volume of regulation and publicised best practice in this area is requiring companies to pay close attention to their ESG behaviours, not only to ensure compliance in the strict legal sense, but also from a strategic and reputational perspective to help them gain competitive advantage and win favour from investors in the market. Indeed, various ‘push’ and ‘pull’ factors can be identified as shifting strategic focus to ESG, including:

- Compliance with mandatory and/or voluntary reporting and legal obligations relating to ESG issues, procedures and standards;

- Corporate values, commitments to deliver on ESG elements of corporate strategy, and a drive to operate ethically, with a clear sense of purpose, and promote more responsible mining practices;

- Competitive advantages in differentiating from peers and securing investment (in particular amidst the rising influence of specialist ESG rating agencies) and facilitating recruitment; and

Technical (including from a health and safety perspective), social, political and reputational risk management, by enhancing community engagement.

Compliance and Reporting Obligations and Codes

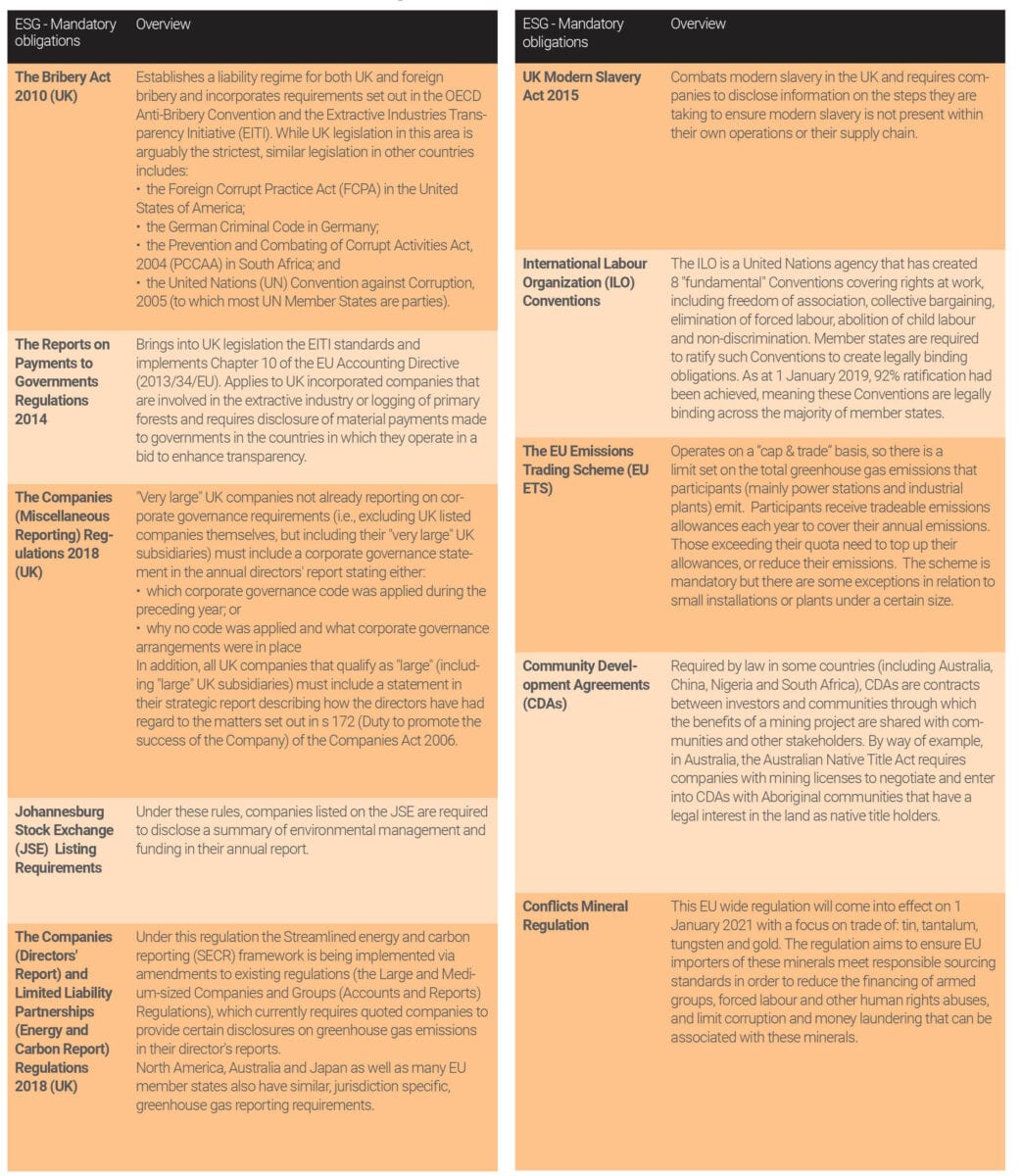

Key Consideration – Mandatory Obligations

ESG requirements are increasingly evolving from loose guidelines to mandatory international and jurisdiction-specific obligations around ESG reporting and standards. The table below summarises some of the more significant laws and regulations that mining companies should be aware of (noting a particular focus on applicable UK legislation given the authors of this article, but also the leading role that the UK government is taking in this area). However, this is just a sample and it is critical that a company undertakes a thorough review of the relevant domestic and international regulation to ensure it is complying with those ESG related requirements to which it is subject.

Mining companies should undertake an analysis of the mandatory laws and regulations in each jurisdiction in which they operate or have entities incorporated, to understand the regulatory framework with which they must comply. Once the scope of compliance requirements is established, a company should prepare and implement a group-wide strategy designed to ensure compliance with the various requirements, through, for example, training, monitoring and reporting. We recommend best practice should include:

- Creation, group-wide socialisation and implementation of a clear corporate strategy / set of business principles with a focus on ESG;

- Articulation of a clear purpose explaining why particular ESG aspects are a key focus for the company, as this will enhance engagement of all stakeholders;

- Appointing ESG expert(s) at board level with ultimate responsibility for ESG compliance matters;

- Appointing compliance officer(s) with responsibility for ensuring that legal requirements are adhered to and reporting and disclosure standards are met;

- Establishing clear lines of reporting for company personnel to allow for swift identification of non-compliance or possible issues/concerns and necessary escalation;

- Provision of resources and training for ESG and other client or investor facing personnel;

- Monitoring of internal ESG performance at every level of the company, including impact and risk assessments; and

- Enhancement of the due diligence process to include ESG specific measures, particularly when appointing contractors or suppliers.

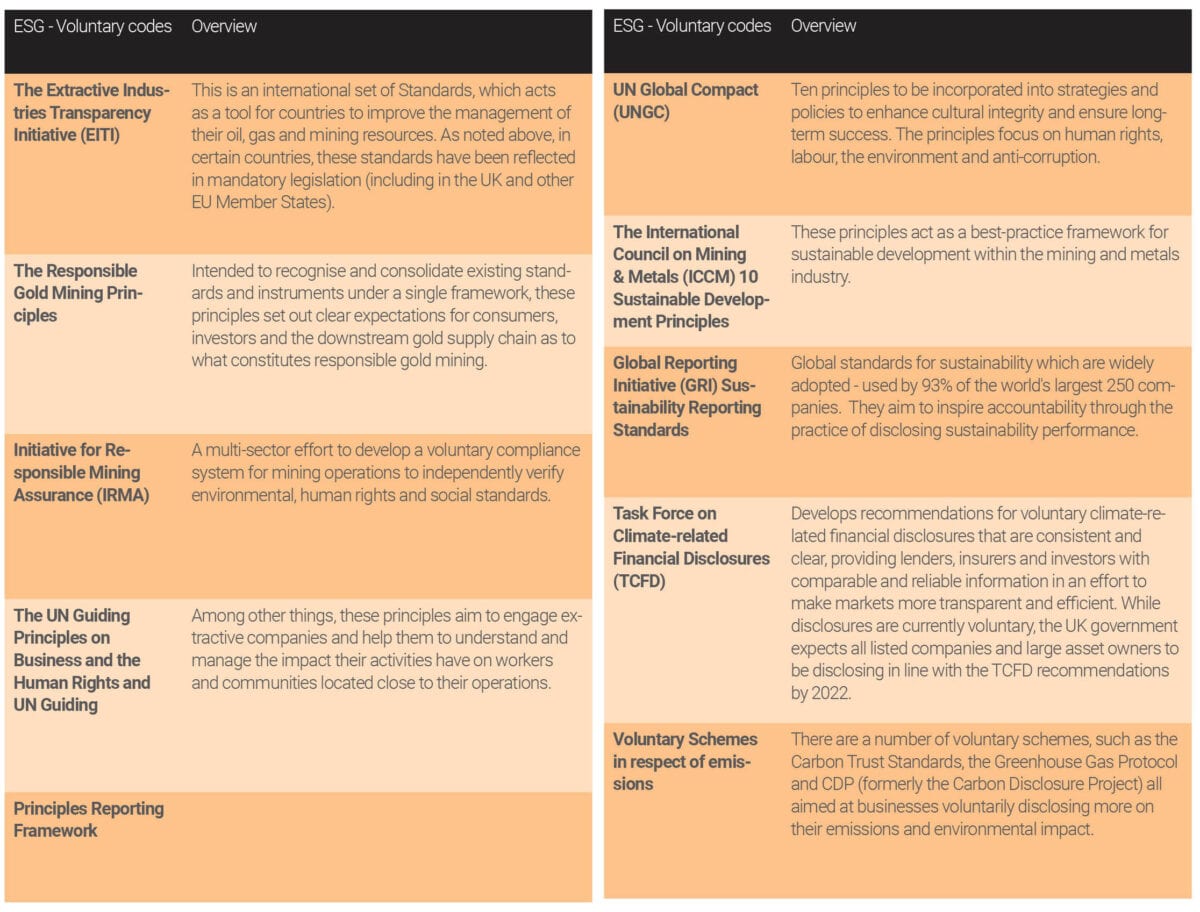

Key Consideration – Voluntary Codes

Many (often overlapping) voluntary codes and principles covering ESG matters have been prepared and publicised by NGOs, industry bodies and other stakeholders, which can make it difficult, particularly for smaller companies, to determine exactly which principles to follow. Some examples of these voluntary standards include:

Recommendations – Voluntary Codes

We recommend that mining companies consider the voluntary codes applicable in each sector and jurisdiction in which they operate (or have entities incorporated), and identify those that they wish to observe and adhere to. In undertaking that exercise, it is important to be ambitious while also being realistic in terms of what the company is able to commit to. Compliance with these voluntary standards should then be built into the company’s group-wide ESG strategy. When considering which voluntary codes to subscribe to, it is worth bearing in mind that:

- Certain voluntary codes may become hard obligations in the future, and so may be worth considering now. For example, the EITI principles have and are being implemented into domestic law in a number of countries;

- Your company may already be complying with certain of the voluntary codes by way of compliance with applicable mandatory codes, in which case it would be possible to sign up to such codes without increasing the overall existing scope of your company’s ESG strategy;

- Providing training to suppliers or contractors in relation to your company’s ESG policies will assist in compliance with various ESG standards which focus on the development of the sector as a whole. Consider whether compliance with these standards (in addition to compliance with mandatory rules) should be incorporated into the company’s standard terms and conditions of contracting with its third party suppliers and service providers; and

- Different investor groups and other stakeholders may be more focused on certain codes than on others – companies may wish to discuss priorities with key investors before signing up to voluntary codes.

Investor Expectations

Key Consideration – Finance Providers

As noted above, investors in mining projects (whether debt or equity) are becoming more focussed on ESG factors when making investment decisions, which means that, in order to access capital, mining companies will increasingly need to demonstrate a robust commitment to addressing and managing ESG concerns and a record of ESG compliance. While certain ESG-related information will be available from public sources with respect to the larger mining groups who are subject to relevant reporting obligations, there are also indices and ratings agencies (such as FTSE4Good, DJSI, Sistainalytics, MSCI) which rank companies according to their actual or perceived ESG strengths. Larger investors may well also retain in-house ESG specialists responsible for assessing these issues.

A number of institutional investors have now publicly committed to taking ESG factors into account when making investment decisions, such as Hermes EOS and BMO. The Dutch pension fund ABP has stated that “responsible investment is central to our investment philosophy” and similarly Blackrock has stated that “we have integrated ESG considerations across our investment research, portfolio construction and stewardship processes”. Prominently, the Norwegian Oil Fund (formally named Norges Bank Investment Management) announced an active exclusion programme under which investment prospects may be blacklisted for ESG breaches.

The European Commission’s “Action Plan on Sustainable Finance” also aims to reform EU financial services architecture by integrating ESG considerations into policy framework and standards across the finance sector, with the aim of promoting sustainable finance initiatives.

In certain markets (such as London), as well as technical, financial and legal due diligence, the increasing influence of ESG rating agencies has resulted in ESG becoming a key focus in relation to larger mining IPOs. Investor roadshows are fast becoming a platform at which investors can and will pose ESG related questions, including how a company’s initiatives align with relevant ESG codes and standards. This means companies that have adopted a more transparent and advanced ESG disclosure framework may be in a better position to attract investors seeking sustainable opportunities.

Alongside the increased equity investor focus on ESG, some lenders are also prescribing particular ESG principles that a company must meet in order to receive funding. This places scrutiny on miners’ management plans and how these will assist the company in meeting its key performance indicators (and indeed, the ESG requirements set out by lenders).

For example, the IFC’s Environmental and Social Performance Standards define responsibilities that apply to investment and advisory clients going through IFS’s initial credit review process and AXA IM have proposed transition bonds which provide an opportunity to finance brown companies with an ambition to transition to green in the future, in industries such as materials, extractives, chemical and transportation.

In addition to informing how investors deploy their capital in the first place, ESG factors have led to a rise in shareholder activism, whereby existing investors use their shareholding to seek to influence the relevant company’s ESG performance. In the oil and gas industry, groups such as Follow This have been making themselves known at annual general meetings, often diverting attention from other key strategic messages which boards wish to communicate. We anticipate that the mining industry will soon follow as a target.

Key Consideration – Other Key Actors

Other bodies, including the World Gold Council, are lobbying for insurance providers to become more involved in the ESG movement, in particular by requiring mining companies to uphold ESG principles in order to be eligible for insurance policies.

Recommendation – Investors

In our experience, preparing (and in some cases, publishing) a clear and robust ESG strategy will help to assuage investor concerns regarding the mining industry, and to promote continued investment. Such strategy should carefully consider both the mandatory and voluntary codes set out above (and the extent to which those voluntary codes should apply to a particular company’s operations), as well as your company’s specific corporate values and overall strategic priorities. It is clearly important to outline how that strategy will be implemented and to demonstrate compliance in practice.

Failing to address ESG concerns at the outset of a project can lead to issues further down the line – we recommend that companies actively engage with investors to pro-actively identify the concerns and explain how they propose to mitigate those ESG risks. Having an open and constructive dialogue not only shows a company’s commitment to the ESG agenda but also potentially dampens the ire of activist shareholders in the future in the face of any issues.

Conclusion

A drive to meet ESG targets and standards should in theory have a positive impact on the mining industry, environmentally, socially and reputationally. However, as ESG targets rise, so will accountability, and so, while mining companies must strive to be ambitious in delivering against ESG goals, they must also be realistic around what is achievable and build an ESG strategy that works for their individual business to avoid perceived failure and, conversely, a detrimental impact on industry reputation.

In any case, with various factors driving mining companies towards enhanced ESG engagement, not least to stay competitive in the market and attract investor capital (individually and from an industry wide perspective), mining companies must continue to push ESG up the corporate agenda and promote good ESG behaviours from the ‘top down’.