A couple of weeks ago, I attended the 34th edition of the biennial PeruMin Convention in Arequipa, Peru, and provided attendees with my at investing in the Andean nation’s mining sector.

The convention definitely leaned heavily towards companies that were supplying goods and services to the industry, but the importance of the sector to the nation’s economy was underpinned by a visit from the interim president, President Vizcarra, who came to power in March 2018 when his predecessor resigned after being caught in a scandal associated with Brazilian construction giant Odebrecht.

(Not pointing figures. Source: Kallpa Securities)

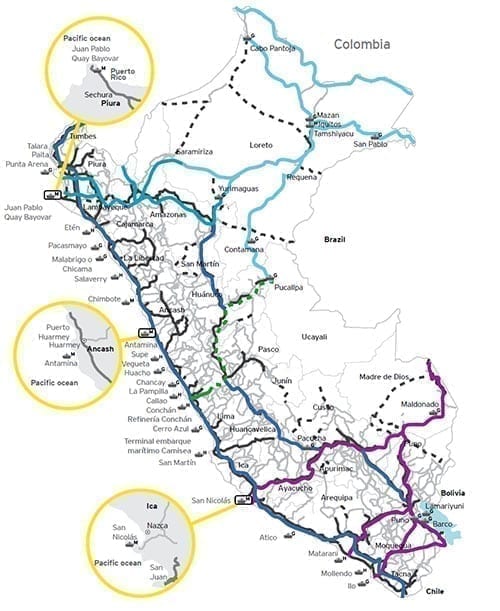

The president wants to “…generate a regulatory framework that is at the level of the mining (sector) with leading-edge technology that is undertaken in Peru“, and highlighted that in 2030 the government will invest USD 300 million in over 50 high-impact infrastructure projects to support a number of sectors including mining (Fig. 1).

(Figure 1: Key infrastructural bottlenecks in Peru. Source: Ministry of Transport and Communications, ProInversion, Ministry of Foreign Affairs and Ernst & Young)

However, according to an Ernst & Young report on the Peruvian mining sector, it is the lack of administrative capacity at the local level, not the availability of funds, that is holding back the construction of roads, hospitals, schools, and water projects, as billions of soles reaped from mining royalties and canons, among other sectors, are sitting idle in bank accounts.

Mining is an integral part of Peru’s social fabric

Mining has been an integral part of the South American nation’s history and culture for over three millennia. , with another peak in 1150 AD at the beginning of the Inca Empire, which was related to metals extraction.

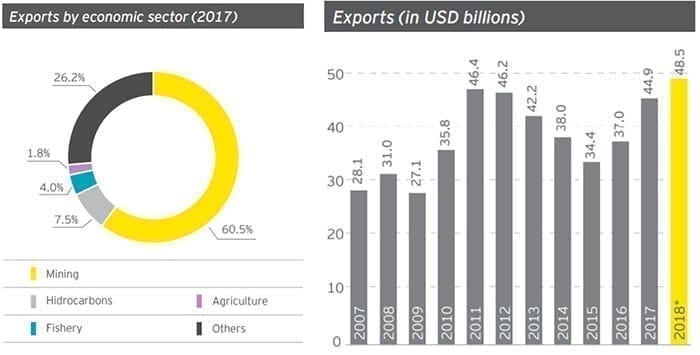

Nowadays, the mining sector contributes 60% of the country’s USD 48-billion-worth annual exports, mainly as copper and gold (Fig. 2).

(Figure 2: [Left] Exports by sector in 2017 and [Right] exports in US dollars since 2007. Source: Peru’s mining & metals investment guide 2019/2020, Ernst & Young)

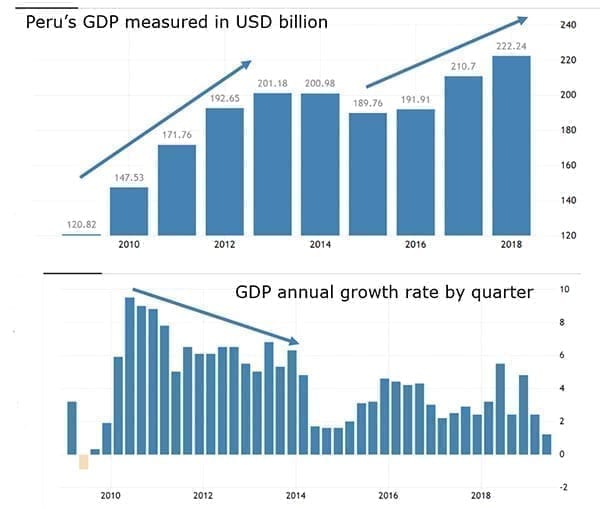

Although the gross domestic product (GDP) annual growth rate has been declining due to a fall in foreign direct investment (FDI) since a peak in 2010, the mining sector’s contribution was up 30% from 2014 to 2018 due, in part, to the lagged impact of FDI.

(Figure 3: Quarterly gross domestic product [GDP, top] and annual growth rate [bottom] since 2009 in US billion dollars. Source: TradingEconomics.com, World Bank and Exploration Insights)

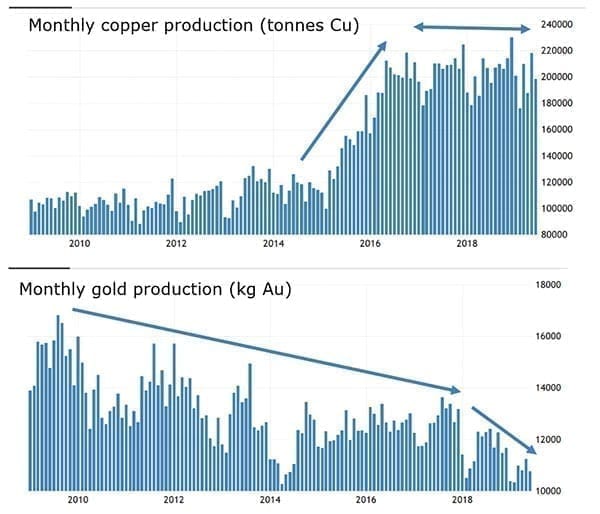

As mentioned above, metal production in Peru, specifically copper and gold, is a significant part of mining-related contributions to the local economy (Fig. 4). Monthly copper production peaked in December 2018 (230 kt), more than double its 2015 levels. However, monthly gold production has been in decline and is currently at less than half (11,000 kg or 350 koz) of its 2005 peak of 22,604 kg (720-730 koz).

(Figure 4: Monthly production of copper in tonnes [Top] and gold in kilograms [Bottom] since 2009. Source: TradingEconomics.com, Central Reserve Bank of Peru, INEI and Exploration Insights)

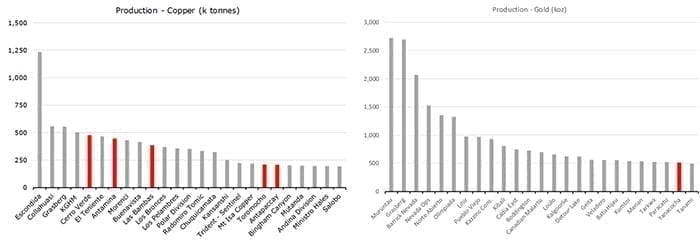

Peru’s strong growth in copper production, supported by five operations that fall within the top 25 of producing mines globally (Fig. 5, left), has puts the nation in second place behind Chile, with respect to annual production (2.4 Mt).

However, the results from the gold sector are mixed. While, at just over 150 tonnes (5 Moz) of annual production in 2018, the country is one of the top 10 producers globally, it has only one gold mine (Yanacocha) that falls within the top 25 (Fig. 5, Right).

(Figure 5: 2018 global copper production by asset illustrating the five major Peruvian copper mines [red, left] and the same scenario for gold showing the position of Yanacocha as the only asset that falls within the top 25 producers [red, right]. Source: S&P Global Market

Peru’s attraction supported by its mineral endowment

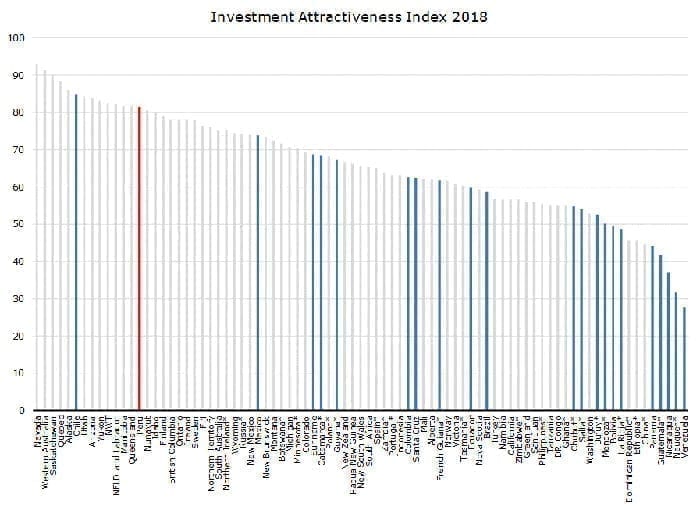

According to the Fraser Institute’s Annual Mining Investment Attractiveness Index, Peru falls within the upper quartile (Fig. 6), second only to Chile among the Latin American cohort.

(Figure 6: Index of mining Investment Attractiveness for 2018 illustrating Peru’s location in the top quartile [red], with its Latin American peer group labeled in blue. Source: Fraser Institute Annual Survey of Mining Companies 2018 and Exploration Insights)

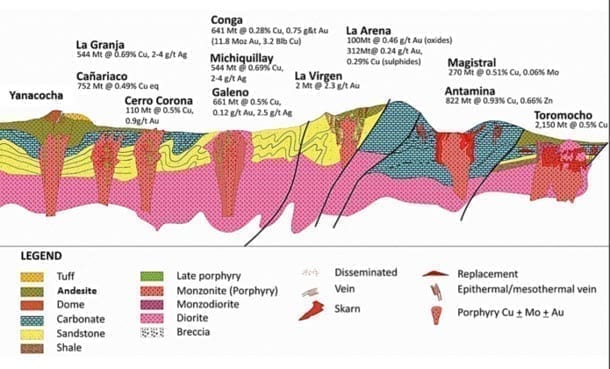

The interest of investors and mining companies in the country is primarily based on its geological prospectivity for a plethora of including porphyry copper, skarns, iron oxide-copper-gold (IOCG), epithermal precious metal systems, and carbonate replacement for all the major metals (Fig. 7).

Furthermore, several of its deposits, such as Yanacocha (epithermal gold), Cerro Verde (porphyry copper), and Antamina (skarn copper-zinc), are considered to be world-class.

(Figure 7: Schematic geological cross-section through Peru illustrating the location of major polymetallic deposits. Source: SEG, Peruvian Geological Congress, ProExplos, Annual Reports compiled by Jorge Acosta, 2013)

The potential of finding another world-class deposit keeps mining companies spending dollars in the country. Exploration funds peaked at over USD 1.0 billion in 2012 (Fig. 8), and at USD 600 million in 2018, ranking it at number four globally, behind Canada, Australia, and the US, and number one in Latin America.

(Figure 8: Annual exploration expenditures in Peru by commodity. Source: S&P Global Market Intelligence and Exploration Insights)

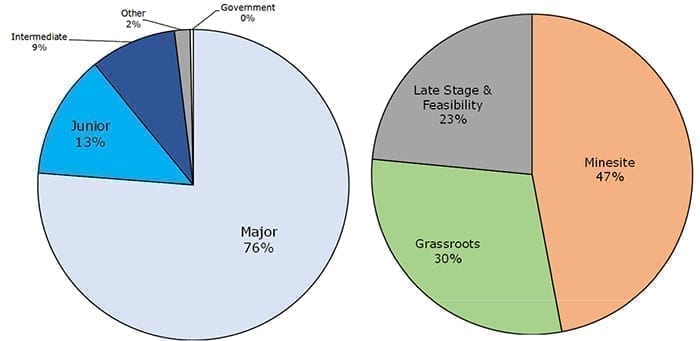

The majority of the funds spent by the 75-80 companies working in Peru were directed to the exploration of copper (40%) and gold (35%) deposits; however, last year, less than 15% of the total was directed to grassroots exploration (Fig. 9), which explains the small number of junior explorers conducting early-stage programs in the country.

(Figure 9: Proportion of 2018 exploration expenditures in Peru [USD 610 M) by company size [left] and stage of development [right]. Source: S&P Global Market Intelligence and Exploration Insights)

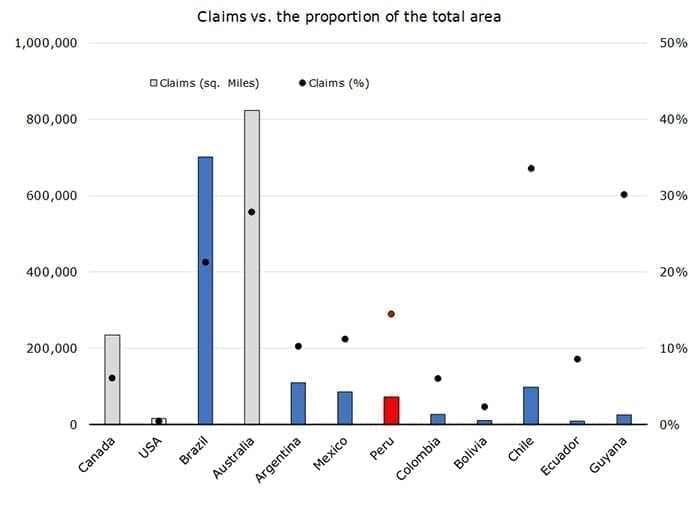

With respect to the extent of the geographic area that has been staked for mining or exploration, only about 14% (90,000 sq mi) of the total has been claimed. This is in line with its peers, such as Mexico, but is far less than that of Chile; a smaller country but the owner of a large uninhabitable territory in the northern Atacama Desert (Fig. 10).

It is interesting to see the small proportion of land staked for mining in the US and Canada versus the high proportion staked in Australia and Brazil. Australia has a large amount of relatively uninhabited deserts in its center whereas Brazil is full of jungle, or at least it was.

(Figure 10: Countries sorted by land size from left to right with total square miles claimed for mining [bars]—Peru in red and its Latin American peer group in blue—and proportion of the country are currently staked [dots]. Source: S&P Global Market Intelligence and Exploration Insights)

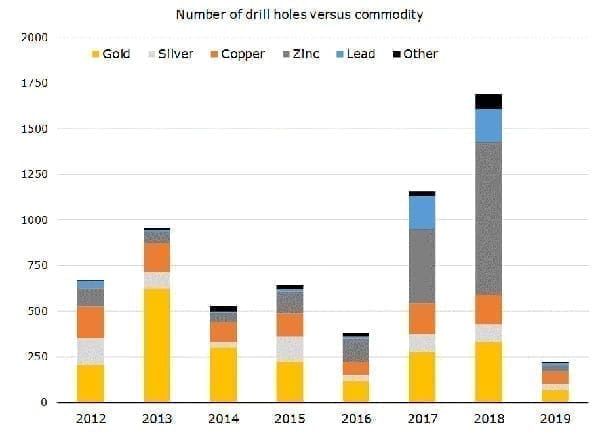

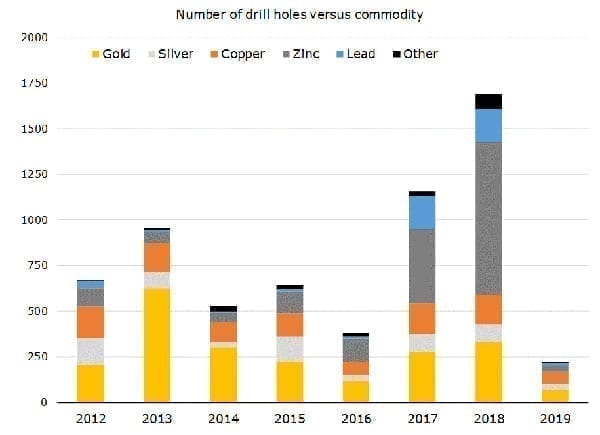

Drilling statistics illustrate that the focus in Peru has been on gold, copper, silver, lead, and zinc in the past seven years (Fig. 11), with a preference for the latter over the last couple of years given the metal’s price appreciation. Worryingly, though, drilling activity has slowed down in 2019.

(Figure 11: Number of drill holes per commodity focus. Source: S&P Global Market Intelligence and Exploration Insights)

Making it difficult to love

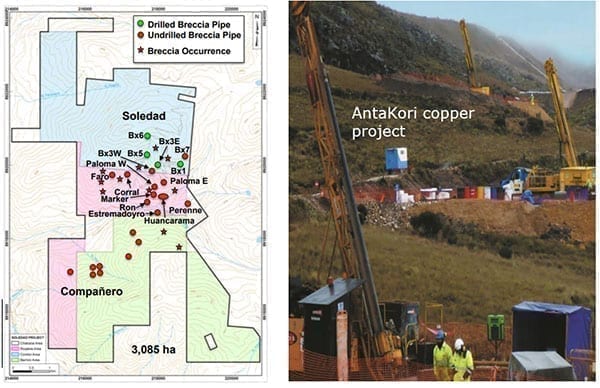

The Exploration Insights portfolio exposure to Peru includes companies exploring and operating copper, zinc, gold, and silver assets throughout the country. As investors in Chakana Copper (PERU.V), we are well aware of delays in the permitting of drilling activity in the country. The company has been waiting over 12 months for modifications of existing permits to allow access to drilling new targets in its Soledad copper-gold project in northern Peru. Likewise, Regulus Resources (REG.V) is still waiting for permits to access the northern portion of its land package at AntaKori (Fig. 12).

(Figure 12: [left] Chakana’s land package highlighting a number of undrilled targets [red] and [right] drilling at Regulus’ AntaKori copper-gold project. Source: Chakana Copper and Regulus Resources)

Peru’s change of presidency in March 2018 was accompanied by a revision of its bureaucratic infrastructure. Currently, there are about six ministries, apart from the Ministry of Mines, involved in any permitting process, which has resulted in a state of paralysis for explorers. Anecdotally, there were 30 permits granted last year, but only six were given the green light to initiate activities.

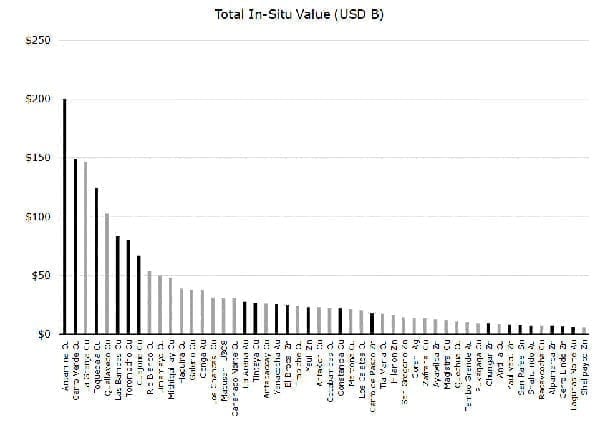

For this and other reasons, about half of the top 50 mining projects in the country (which represent USD 1.8 trillion of in-situ value) are sitting idle, stagnating the growth of the local mining sector and its potential positive impact on the economy (Fig. 13).

(Figure 13: The top 50 mining projects by in-situ value those highlighted in black are operating and those in grey are not operating. Source: S&P Global Market Intelligence and Exploration Insights)

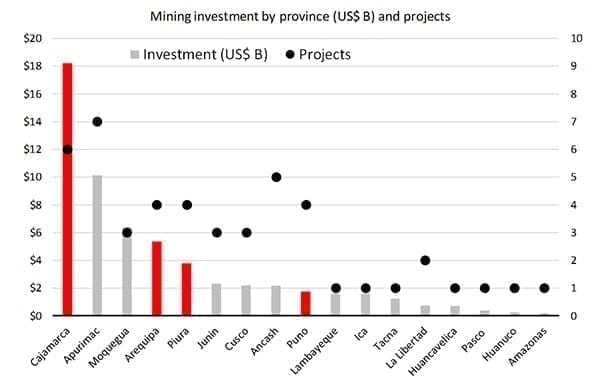

With this as the backdrop, the Peruvian Minister of Energy and Mines announced at the PeruMin Convention that there are 48 mining projects (USD 60-billion-worth) expected to be completed in the mid to long-term. The downside to this plan is that 18 of those projects are located in “problematic” provinces (Fig. 14).

(Figure 14: Number of current mining projects in Peru [dots] and development costs [bars] by province, highlighting problematic jurisdictions in red. Source: Ministry of Energy and Mines, 2018)

Recent examples include Newmont Goldcorp (NEM.NYSE, NGT.T) being forced to abandon the development of the USD 5 billion Conga copper-gold project in Cajamarca, violent opposition to the USD 1.8 billion Tia Maria copper project operated by Southern Peru Copper in the Arequipa region, and protestors blocking the highway that runs from the Las Bambas mine to the Port of Matarani in Apurimac.

(Figure 15: [top left] Community opposition to the Conga copper-gold project in Cajamarca, [top right] violent opposition to the development of the Tia Maria copper project in Arequipa, [bottom left] blockades at Las Bambas that halted concentrate shipments to the Port of Matarani [bottom right]. Source: Revista Ideele, Mining.com, New Straits Times and CruiseMapper)

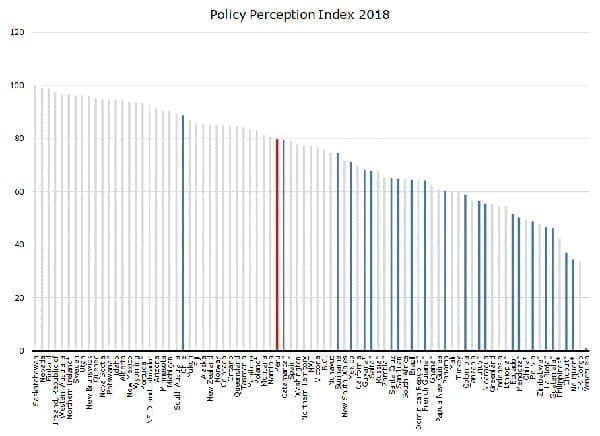

In the Fraser Institute’s Annual Survey of Mining, companies that responded to policy factors that affect investment decisions (Policy Perception Index) put Peru in the middle of the pack, which is well above the majority of its Latin American peer group, but far behind Chile (Fig. 16).

(Figure 16: Policy Perception Index for 2018 illustrating Peru’s location [red] in the middle of the pack with its Latin American peer group in blue. Source: Fraser Institute Annual Survey of Mining Companies 2018 and Exploration Insights)

President Vizcarra’s fight against graft and corruption has support among the citizenry but it has led to a direct conflict with the opposition-led Congress. In order to end the impasse, the president has proposed an early general election (July 2020).

An unstable local political landscape and the potential for yet another election will only add more uncertainty, which is not conducive to attracting significant inflows of capital from foreign investors to the mining sector or any other for that matter. To see the capital inflows that will drive GDP growth, the mining minister needs to realize his goal of improving public policies and disentangle the regulatory framework.

Although I am not keen to add to my exposure to Peru at this time, I will continue to hold the Peruvian explorers in the portfolio for the time being, anticipating a resolution of permitting delays before the coming election and banking on the geological prospectivity of the country to host more major world-class deposits.

Disclosures

Of the companies mentioned in this week’s letter, Exploration Insights owns shares of Chakana Copper (PERU.V) and Regulus Resources (REG.V).

[Note that our trading activity is based on our investment thesis, which can be short- (tactical) or long-term (strategic), but the timing will not always be perfect due to market volatility and share price liquidity. As a subscriber, you may want to purchase/sell a stock sooner or later than we do. As we need to justify our purchases and sales while allowing our subscribers to trade with us, we, unfortunately, cannot always act as quickly as we would like. We also want to remind all our subscribers that they have access to the open and closed positions in the EI Portfolio via the website. As soon as we execute a trade, we update the price and date of the open and closed positions, depending on whether the position was purchased or sold. There can be delays due to the illiquidity of some of the junior mining stocks and the time needed to link a new stock to our website. Our site visit expenses are covered by the company.]

Disclaimer

This letter/article is not intended to meet your specific individual investment needs, and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be–either implied or otherwise–investment advice. This letter/article reflects the personal views and opinions of Joe Mazumdar, and that is all it purports to be. While the information herein is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information herein may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. Research that was commissioned and paid for by private, institutional clients is deemed to be outside the scope of the newsletter, and certain companies that may be discussed in the newsletter could have been the subject of such private research projects done on behalf of private institutional clients.

Joe Mazumdar, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter/article. The information contained herein is subject to change without notice, may become outdated, and may not be updated. The opinions are both time and market sensitive. Joe Mazumdar, and the entities that he controls, family, friends, employees, associates, and others, may have positions in securities mentioned, or discussed, in this letter/article. While every attempt is made to avoid conflicts of interest, such conflicts do arise from time to time. Whenever a conflict of interest arises, every attempt is made to resolve such conflict in the best possible interest of all parties, but you should not assume that your interest would be placed ahead of anyone else’s interest in the event of a conflict of interest.

No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Joe Mazumdar. Everything contained herein is subject to international copyright protection.