A major new bull market is underway in all raw materials. Its root cause is the gargantuan amount of new money being printed by central banks all over the world, combined with supply shortages due to Coronavirus-related disruption that will come to the fore over the next 12 months or so.

Students of previous commodity bull market cycles will be aware that the first mover in a synchronised rotational commodity upswing is usually gold, as this is the first commodity to react to excess monetary creation. In August this year, gold hit an all-time high measured in all major currencies, not just the US dollar. Since America came off the gold standard in 1971, the US currency has lost 98% of its value versus gold, which has gone up from about USD 38 per troy ounce to around USD 1,900 at the time of writing. Such is the power of currency debasement.

Despite gold’s strong run this year, some investors may be a tad hesitant of chasing the price higher. However, our long-term cycle analysis shows that there is still considerable upside for gold as it heads towards the top of its 20-year cycle, which is expected to peak in next couple of years. It is worth remembering that in the last great bull market for gold (which peaked in 1980), 40% of all the gains seen by the metal were achieved in the final nine months of the up-cycle.

The good news is that other commodities are now also entering a bull market and gradually gaining momentum as they also offer a hedge against currency debasement. Copper, silver, nickel, wheat, coffee, etc., are all ultimately just as inflation-proof as gold – save that these commodities do not all go up at the same time and tend to trade in rotation.

Looking at the issue of currency debasement, the current level of money printing in the West is unprecedented and is being led by the US with new money creation running at 20% of gross domestic product. Also, unlike the Federal Reserve’s first three phases of Quantitative Easing (QE), the latest round of money printing (amounting to USD 4 trillion) is being injected directly into the real economy, whereas the previous rounds of QE tended to stay within the banking system.

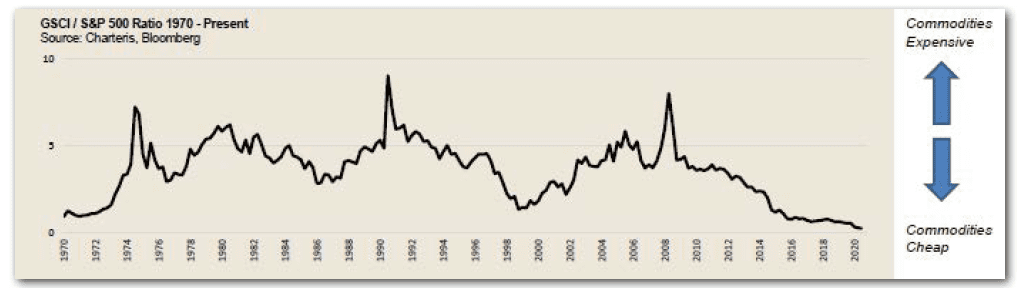

Commodities are also cheap relative to other assets based on historical standards as can be seen in the chart below, which shows the long-term ratio of the Goldman Sachs Commodity Index relative to the S&P Index of U.S. equities. This chart shows that commodities have never been cheaper relative to US stocks in the last 50 years, providing an exceptionally favourable opportunity to gain exposure to commodities.

So, if we accept that a new commodity bull market is underway, which commodities offer investors the best prospects for making money? Although the rising tide of money creation will lift all commodity boats, there are some worth highlighting as they are likely to benefit from both cyclical and fundamental factors. Copper merits close attention as the world transitions to a decarbonised and digital paradigm that involves an irreversible switch to electric cars. It takes four times more copper to make an electric car than a petrol/diesel car. Add in the charging systems and wind turbines that need vast amounts of the red metal, and the demand side of the equation becomes easy to identify. What is a lot less certain is where all of this extra copper is going to come from.

“Investors need to appreciate that decarbonising the world without metals such as copper and silver will be impossible to achieve“

Likewise with silver, which is an essential ingredient in solar panels, it is easy to identify future solar-related demand for silver, but it’s not so easy figuring out where the extra silver will come from, especially at prevailing prices. Most silver is mined as a by-product of lead and zinc mining so it is not as straightforward as increasing the supply of silver in reaction to a big silver price rise – it needs a big move up in lead and zinc prices in tandem to prompt mining companies to ramp up production. Thanks to COVID-19, production of these metals has been curtailed as many mines in Latin America have been forced to temporarily shut down or scale back operations on health and safety grounds.

Some investors are wary of commodities and mining shares due to concerns about excess volatility, either real or imagined, but we contend that it is valuation levels that will determine the returns. How much an asset moves up and down every day is not, and should not be, the defining factor. Cash on deposit has no volatility but if and when inflation goes back up, cash risks generating negative “real”, i.e. inflation-adjusted, returns, especially if interest rates stay close to zero.

What should investors look at as possible investments in order to take advantage of this expected up-move in commodities? Gold assets have already enjoyed strong gains – our own gold fund is up 50% this year following on from a similar gain in 2019, ranking it the top-performing UK fund of the year across 2,500 funds from all categories. It is now worth looking at other commodities that have not moved as much to diversify risk and boost performance.

The obvious way to gain exposure is through big base metal miners such as Rio Tinto, BHP, and Antofagasta, which are listed in London and are among the top 100 UK shares by market capitalisation. An added attraction is that these companies offer above-average dividend yields and are valued at low multiples to their expected earnings. Rio, for instance, is on a forward P/E multiple of under 10 times and offers a dividend yield of 6.3%. Furthermore, if the prices of base metals start to rise, these multiples will fall even lower while the dividends will go up. Compare that to the risks of investing in long-dated gilts with yields of 0.75% fixed for 50 years or so; these gilts will be the prime victims of any upturn in inflation, whereas the mining shares are direct beneficiaries.

The current debate against investing in mining companies is over Environmental and Social Governance (ESG) concerns, but investors need to appreciate that decarbonising the world without metals such as copper and silver will be impossible to achieve.