After a year and half of decline, Chinese spot prices for both lithium carbonate and hydroxide fell below USD 10,000/t in Q3.19. This represented their lowest levels since 2015 and well below levels above USD 20,000/t achieved in late-2017.

From early 2018, prices started to fall as fears of a looming supply shortage began to subside, helped by the construction and commission of several Australian projects, the continued progression of many evaluation stage projects, and numerous new discoveries. As we moved into 2019, prices weakened further as near-term demand growth expectations fell short of expectation. This has led to a sizable market surplus in 2019 and many longer-term market growth rates being moderated downwards. As a result, sentiment in the sector has fallen as sharply as prices, while the share price of many constituent companies has dropped even more dramatically.

In addition to market conditions reducing the markets’ ability to absorb new supply, since the beginning of 2018 several other factors have also weighed on the sentiment of lithium project developers.

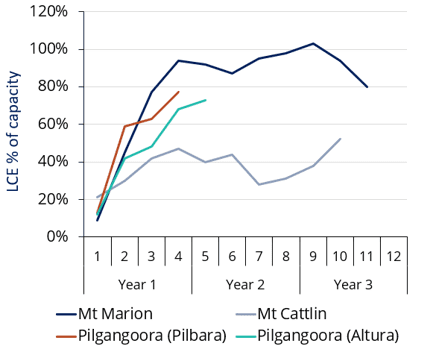

Project Start-ups Missing Ramp-Up Targets

The past couple of years have seen the start up of several lithium projects in Australia. However, as these mines have ramped up, one common theme has emerged: the struggle these projects face in meeting their design recovery rates and, as a result, hitting production capacity.

Recent spodumene project ramp-up success

Source: Roskill – Lithium Cost Model Service

Spodumene recovery rates can be impacted by several factors, including ore grade, mineralogy, amount of deposit weathering, presence of slimes and concentrations of associated gangue minerals (such as feldspar, quartz and mica), and plant design. In the mining sector, it’s fairly common to see issues with projects as they ramp up to nameplate production capacity. However, these issues appear to be widespread when it comes to lithium, with several of the longer-standing projects finding that these issues have persisted

This is perhaps not surprising given the limited number of lithium operations that have been in production historically, meaning that industry expertise in designing these plant flowsheets is limited. Meanwhile, there are a limited number of currently operational plants from which to benchmark a project’s plant design and lab-based recovery rates againstAs such, it’s conceivable that some of these projects might not reach their design recovery rates.

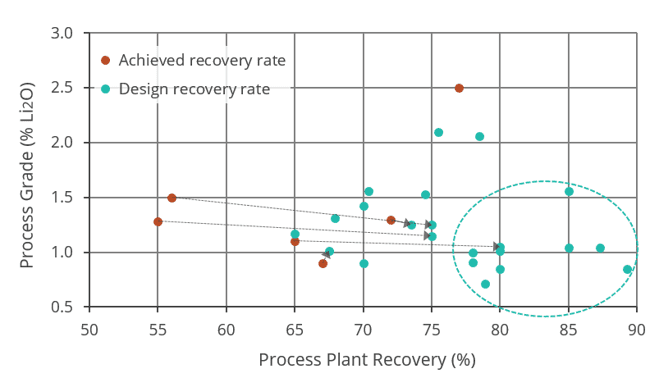

Furthermore, many of the technical reports for projects currently under development put forward recovery rates above 75 percent (as shown in the chart below), which is notably higher than many of the rates currently being realised.

Spodumene recovery rates versus process feed grade1

Note: The arrows highlight the difference between recovery rates achieved and the projects design rates.

Source: Roskill – Lithium Cost Model Service

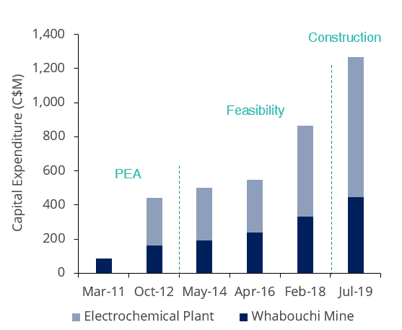

Nemaska’s Capex Blowout

In February 2019, following eight months of construction, Nemaska (once a promising example of the lithium development sector) announced that they required additional funding to complete the construction of their Whabouchi mine and lithium hydroxide processing plant in Quebec, Canada. This was due to capital cost inflation associated with higher-than-anticipated construction costs and a requirement to improve the specification of the steel used within the processing plant. As a result, the capital cost estimates for construction of the integrated project have risen from the CAD 875 million outlined in the feasibility study (FS) 12 months prior, to CAD 1.27 billion. This revision adds to significant levels of project capital inflation that have occurred through the development of the project. Between the publication of the project’s initial preliminary economic assessment (PEA) for an integrated operation in 2012 and the 2018 FS, the capital cost for the Whabouchi mine doubled from CAD 163 million to CAD 333 million (and now stands at CAD 447 million). Meanwhile, the spodumene refining facility’s capital budget rose from CAD 277 million to CAD 541 million, with CAD 231 million of that gain occurring between the 2016 and 2018 FS. It now stands at CAD 821 million.

Capex evolution of Nemaska’s integrated lithium hydroxide project

Source: Roskill/Company reports

This highlights the potential risks of utilising new and commercial unproven processing technologies within the development of a project, while also outlining the importance of detailed and extensive engineering work before financing and construction begin. However, it’s not just Nemaska’s project that looks to use a new processing route. Many of the projects in the development pipeline proposed the use of commercial unproven flowsheets to process lithium-bearing clays, lithium-boron mineralisation, and mica-based deposits, while several of the brine projects hoped to utilise various proprietary direct extraction technologies to produce lithium carbonate from a variety of aquifers. It’s also not just Nemaska that has incurred major capital overruns in the development of a lithium project. Tianqi Lithium recently published an update on their lithium hydroxide plant in Kwinana. This outlined a comparable capital blowout but, in contrast to Nemaska, Tianqi is using a more conventional processing route, in line with existing plants in China, some of which the company already operates.

Royalty Payment Hikes and Surprise Export Taxes

In many lithium-producing countries and some potential ones, royalty rates on lithium are coming under scrutiny. In 2017 and 2018, state-owned Corporación de Fomento de la Producción de Chile (CORFO) renegotiated production licences at the Salar de Atacama operations, which resulted in significantly higher royalty payments for Albemarle and SQM, albeit with an increase in their licenced production volumes. In neighbouring Argentina, the government enacted temporary measures in September 2018 which imposed an export tax (customs duty) that impacted production costs and the profitability of operations and a swathe of new projects there. The measure is expected to run through to December 2020, although given the worsening economic state of the country, the government might have limited scope to remove it at that point.

Meanwhile, the Western Australian government recently completed a review of its lithium royalty structure and elected to keep rates in line with the previous structure (5 percent on spodumene concentrate) for domestically-processed material. In Bolivia, there have been recent protests calling for the government to end a project with German company ACI Systems that’s focused is developing the country’s sizable (although geochemically challenging) Salar de Uyuni lithium resource. These examples continue to highlight just how politically charged the control and production of battery raw materials is becoming as many parties look to cash-in (and arguably, rightly so) on what looks set to be one of the major industries of the 21st century.

What Does This Mean for the Future of the Lithium Sector?

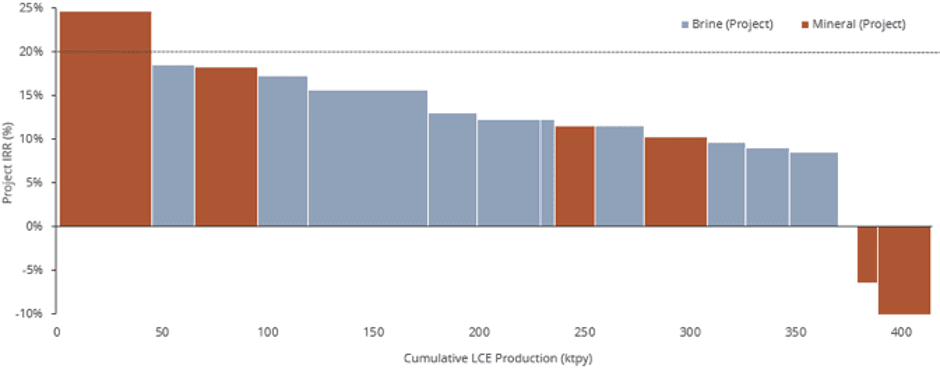

Longer-term, it is still necessary for the industry to deliver sustained supply growth to fuel the next wave of electric vehicles; these new EVs will be driven by economics rather than government-based incentives. However, current prices and sentiment are providing limited incentive to develop much of the greenfield capacity currently being evaluated, and this may well impact the sector’s ability to meet future demand growth. As shown by the chart below, only one of the lithium projects analysed within Roskill’s Greenfield Battery Raw Material Projects Report generates an IRR above 20 percent at current prices.

Project IRR of greenfield lithium projects at current prices

Source: Roskill – Lithium Cost Model Service & Greenfield Battery Raw Material Projects report

In the evaluation of these greenfield projects, we have used current spot prices as opposed to (which are currently at a premium) for refined lithium products. Although project developers will look to establish long-term off-take agreements prior to construction, it seems unlikely, at least in the initial years of operation, that they will be able to command the same pricing levels as established major producers. The latter currently dominate the contract market and have an established record of delivering proven battery-grade product, while new producers don’t and therefore will bemore susceptible to spot pricing.

Furthermore, as highlighted above, within a technical review of a project factors such as capital budget, ramp-up rate, and utilisation often represent a best-case scenario, and many projects fall short of this, significantly diminishing their return on investment. As a result, when flexing some of the project assumptions to build in just a 25 percent overspend in capex and a plant utilisation rate 15 percent below capacity, even the best projects (as in the chart above) struggle to deliver an IRR above 15 percent. In fact, most fall below the 10 percent threshold.

In addition, with demand for lithium set to grow at a notably slower rate than earlier estimates, a portion of the required new supply will be more easily met via brownfield expansions at existing producers which, in many instances, provide stronger returns on investment than their greenfield counterparts. It will also provide a longer window for other major mining companies, such as Rio Tinto, Posco, and Eramet, to establish a foothold within the lithium industry.

Longer-term, however, we remain sceptical of the ability of these (few) assets to generate the sustained levels of supply growth required to meet the rise in demand. As a result, prices will need to rise markedly to incentivise the development of these projects. Furthermore, it’s also arguable that lithium projects need to provide better investment incentives than other mining projects, not only to support lithium’s longer-term growth profile but also, and perhaps more importantly, to cover the uncertainty shrouding lithium demand over the long-term. This principally relates to developments in EV powertrain technologies, which not only could shift demand within lithium (i.e. from lithium carbonate to hydroxide or, potentially, to another form of lithium) but could even eliminate its requirement altogether.