We believe that at this stage in the cycle, the fundamentals for natural resources, and commodity markets, specifically, are positive. There is a bull case for investing in commodities that, should we see a trade resolution or stability in economic growth, would see commodity prices rally, positively impacting the earnings outlook for natural resources companies at a time when valuations are cheap versus history.

What is the Bull Case for Commodities?

We believe the bull case in commodities can be made as follows. A trade resolution is likely to spark a rally in commodity prices, driven by increased demand resulting from a restock, during a period when limited supply is available across most commodities. This would result in upgrades to company earnings forecasts, likely see earnings multiple expansion, and increasing investor demand for exposure in the sector. This view is predicated on a trade resolution, however, which remains uncertain, and we continue to manage the fund cautiously until we see such resolution.

If we wind the clock back approximately two years to late 2017, the outlook for global economic growth was incredibly positive. At the time, economic commentators forecast a prolonged period of economic prosperity and synchronous global growth, a nirvana for commodities investors driven by strong commodity demand and generally constrained supply. During 2018, the demand side of the equation has been broadly derailed, however, by economic uncertainty, in our view ultimately driven by trade wars.

Trade Concern has Driven Uncertainty, Which is Impacting Economic Activity

The US trade conflict started in early 2018, when President Donald Trump sought to renegotiate legacy trade agreements with most trading counterparties. The most prominent trade conflict remains between the US and China, however the US has also renegotiated a number of trade agreements including Canada, Mexico, Germany and Japan over the past 18 months.

The weapon that has been used by the Trump administration to negotiate trade deals has largely been the enforcement of tariffs. This has a double negative impact on markets, in the actual tariff cost drag of those already implemented, and in the damping effect on future investment and development because of an uncertain policy and tariff outlook.

The Building Blocks of Uncertainty: Tariffs

The threat, and uncertainty around potential tariffs is a significant drag on economic activity and investment. To take this down to basic building blocks, let’s consider the case of a Chinese manufacturer exporting goods to the US. Absent of tariffs, the manufacturer broadly knows the selling price into the US, subject to foreign exchange movements.

Let’s assume the exporter is selling a Chinese manufactured air conditioner for US$100 per unit into the US, where the cost to manufacture is US$80 per air conditioner unit, representing a reasonable US$20 profit per unit. So what happens when there is a threat of tariff increases? Immediately, there is uncertainty around the manufacturer’s selling price. Will the product receive US$100, US$100 less a 5% tariff (cutting his margin significantly), or US$100 less a potential 25% tariff (meaning the manufacturer could lose money on each unit sold)? All of a sudden, a stable and profitable operating business becomes loss making, or the manufacturer raises prices to meet the tariff and preserve profit margin, but at the risk of losing market share to competitors.

Under this scenario, what would be a sensible business decision for the manufacturer? Reduce production and sell from inventory? Defer capital spending and any expansion plans? Refurbish old equipment rather than invest in new equipment (delay investment decisions)? Delay plans to employ additional employees? Or raise prices and risk losing customers? The answer is likely to be some or all of the above, but even more likely to be a ‘stop and wait’ approach to new investment and hiring staff at best, and shedding staff and reducing plant capacity or shuttering the business at worst.

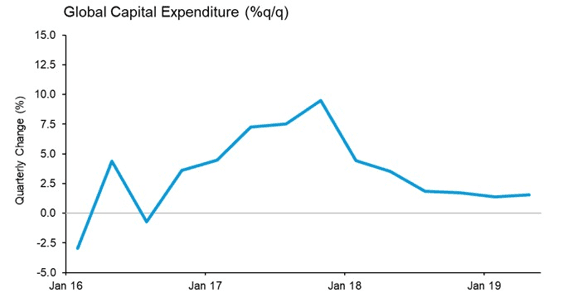

Broadly speaking, we believe such scenarios, and the resultant uncertainty, has been playing out globally over the past 18 months, ultimately leading to manufacturers destocking inventory globally and deferring capital investment decisions, as illustrated in Figure 1.

Figure 1: Global capital expenditure has been declining with rising tariffs

Source: Bloomberg.

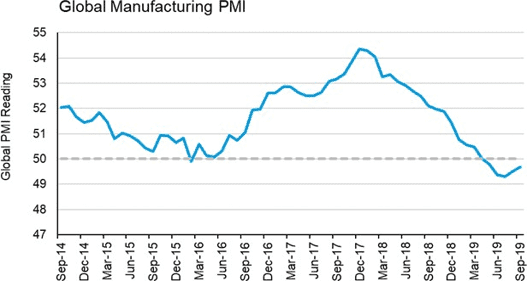

Global manufacturing PMI (purchasing managers’ intentions), as the key indicator for global economic growth, has been weak since trade rhetoric increased in early 2018. This can be seen in Figure 2, below. A PMI reading of below 50 indicates contraction, while a reading above 50 represents expansion.

Figure 2: Global PMIs as an indicator of economic activity

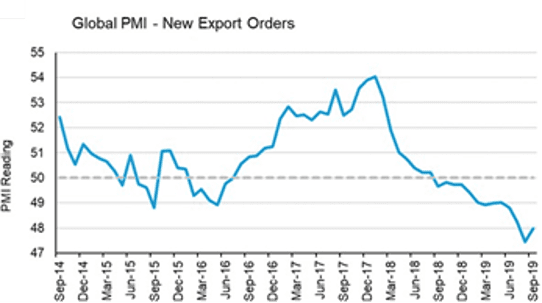

From a trade perspective, new export orders have exhibited an even more pronounced contraction which has negatively impacting demand for products, and global trade data has followed a similar trend, as illustrated in Figure 3.

Figure 3: The recent collapse in new export orders from the extended trade war

Source: Bloomberg.

In summary, uncertainty drives reluctance to buy and invest in the future. Our core view, at this point in time, is that trade wars, primarily but not exclusively between the US and China, have negatively impacted manufacturing in general, business confidence, and ultimately the demand for hard commodities. We believe there has been a destocking in most manufacturing supply chains, driven by this uncertainty, and we believe this is likely to reverse significantly on any trade resolution, should it occur.

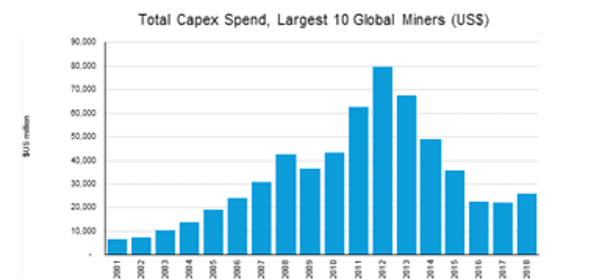

Underinvestment in New Commodity Supply

While demand for commodities is being negatively impacted by trade uncertainty, we also believe supply in general is being constrained. Following a long period of capital investment in new mining and commodity projects that peaked in 2012, we have seen a reduction in new capital spend and investment, reflected in limited new production coming on-line across a number of commodities (although there are some exceptions within the commodity complex), as illustrated in Figure 4.

Figure 4: The rise and fall of investment in future commodity capacity: Capex spending

Source: Company Data, Bloomberg

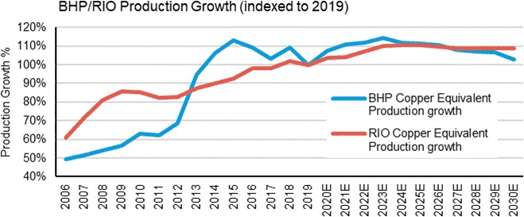

A similar trend is evident in the numbers on production growth across the portfolios of the major miners, particularly as an indication of the broader supply outlook for the mining sector, as outlined in Figure 5. We have seen a focus on returning cashflow to shareholders, rather than investing in new projects. We view this cashflow focus by global miners as a positive, but this does mean growth in portfolios is limited.

Figure 5: Plateau in production capacity is constraining supply: Requires new investment

Source: Company data, Ausbil Forecasts

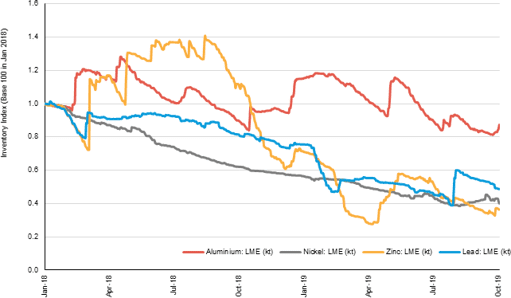

Interestingly, even though we have experienced weak commodity demand, visible inventory for most commodities has been falling, as illustrated in Figure 6. This also suggests a tight market, despite weak demand.

Figure 6: Falling inventory from underinvestment in capex: Base metals complex

Source: Bloomberg

Broadly speaking, Ausbil is of the view that new supply in most commodities is constrained, and any increase in demand will lead commodity price increases, which is broadly supportive for natural resources equities.

Valuations Are Not Stretched

Hard commodities are leveraged to economic growth, and thus a slowdown in economic growth will impact commodity demand. Trade concerns, and the possible impact on economic growth have therefore weighed on natural resources equities and indices with commensurate discounts in trading valuations as uncertainty persists. Since the start of 2018, the MSCI Select Natural Resources Index has underperformed the MSCI World Index by 18.1%, as illustrated in Figure 7.

Figure 7: Bifurcation, the relative performance of natural resources to global equities

Source: Bloomberg

As specialist natural resources investors, this disparity in value represents both an opportunity, and a challenge. The opportunity is driven by the potential for a significant re-rating in natural resources equities relative to general equities should global economic concerns dissipate. The challenge is that economic conditions could continue to deteriorate, and natural resources equities continue to fall.

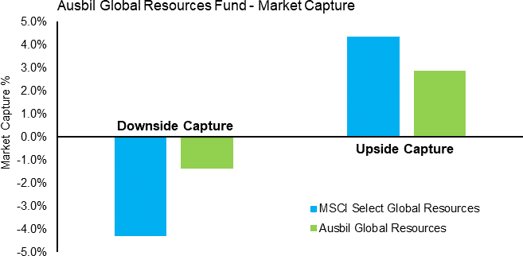

The absolute return overlay we apply with the Ausbil Global Resources Fund, however, has allowed us to protect capital during the downturn, while providing us with the opportunity to leverage any recovery in natural resources. The following chart displays the upside and downside capture performance of the Ausbil Global Resources Fund in down and up markets relative to the MSCI Select Global Resources Index, Figure 8.

Figure 8: Returns skewed to the upside: Upside and downside capture for the Ausbil Global Resources Fund

Source: Ausbil, Bloomberg

Adjusting Market Exposure to Capitalise on Opportunities

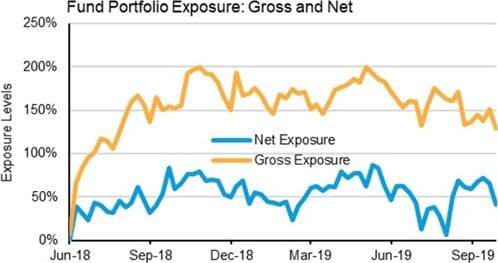

The Ausbil Global Resources Fund is able to seek capital protection by adjusting market exposure (the quantum of long or short positions). This is measured by net exposure (long exposure less short exposure).

Since inception, the Fund has operated in a declining natural resources equities market, yet it has generated positive returns, despite maintaining a long bias during this period. Ausbil has achieved this through selecting stocks which have outperformed during the period, while adding a short overlay which has allowed us to capitalise on falling share prices. The following chart outlines the variations in net and gross exposure levels for the Ausbil Global Resources Fund across the recent volatile markets, Figure 9.

Figure 9: Ausbil Global Resource Fund – Exposure Levels

Source: Ausbil

Natural Resources Equity Valuations Trading at Discounts to Historical Levels

There are two main reasons that the Fund has retained a long bias through the volatility experienced since inception. Firstly, we believe economic growth concerns and weakness in commodity prices and natural resources equity prices have primarily been driven by trade concerns. There have been numerous opportunities for trade issues to be resolved. We believe a partial or full trade resolution would lead to a significant increase in commodity prices, a restock throughout most supply chains, and a significant and extended period of strong performance for natural resources equities.

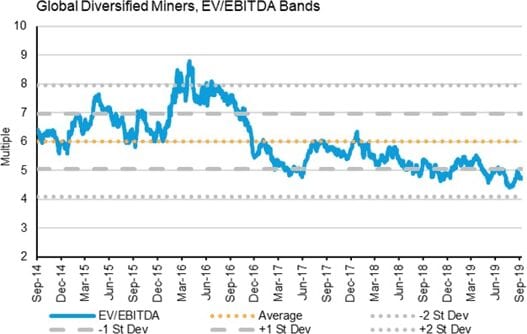

Secondly, natural resources equities valuations are not currently stretched, and the sector in general is cheap. This is understandable at the moment, given investor risk appetites. Figure 10 shows the current EV/EBITDA multiple (a measure of valuation) for a basket of 5 global diversified miners. Currently, the basket is trading at around 1.5 standard deviations below the 5 years average.

Figure 10: EV/EBITDA has fallen significantly since the recent peak in 2016

Source: Ausbil, Bloomberg,MSCI

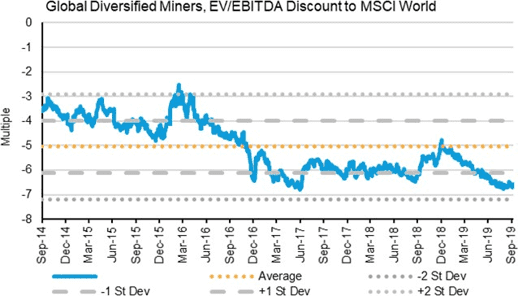

A similar trend is evident when we compare the same basket to the trading multiple of the MSCI World Index, where the basket is trading at 1.5 standard deviations below the 5-year average discount, as illustrated in Figure 11. Over the past 5-years, the basket has, on average, traded at around a 5.0x EV/EBITDA discount to the MSCI World Index multiple, but is currently trading at around 6.6x discount.

Figure 11: Natural resources EV/EBITDA has fallen significantly since the recent peak in 2016

Source: Ausbil, Bloomberg, MSCI

Conclusion: A Significant Opportunity for Active Management

While significant risk and volatility remains in global equities markets, driven by trade and economic uncertainty, opportunities remain to generate absolute returns across the cycle. Natural resources valuations are not stretched at the moment, but we believe the current volatile market means a simple buy-and-hold strategy in the resources sector would represent a risky approach.

Fundamentally, we believe there is a possibility that a partial or full trade resolution may occur shortly. This would represent a key positive catalyst for commodity prices and natural resources equities, however we continue to manage our portfolio cautiously until we see a resolution eventuate.

Trade resolution could result in the forward looking ‘Goldilocks’ scenario of synchronous global growth, representing a return to the economic outlook before trade wars commenced, further supported by stimulus that has been implemented to support growth. This would represent an even more compelling opportunity for investors in the natural resources space.

The Ausbil Global Resources Fund uses an absolute return overlay to protect capital during volatile markets, while offering significant leverage to natural resources equities in a rising commodity price environment. This has significantly outperformed natural resources indices since inception1, during a declining and volatile market. We intend to continue active management of the portfolio, managing downside risk until we see resolution in the trade conflict, or stability in economic growth, or preferably a mix of both.

Disclaimer The information contained in this document is given by Ausbil Investment Management Limited (ABN 2676316473) (AFSL 229722) (Ausbil) and has been prepared for informational and discussion purposes only and does not constitute an offer to sell or solicitation of an offer to purchase any security or financial product or service. Any such offer or solicitation shall be made only pursuant to an Australian Product Disclosure Statement or other offer document (collectively Offer Document) relating to an Ausbil financial product or service. A copy of the relevant Offer Document may be obtained by calling Ausbil on +612 9259 0200 or by visiting www.ausbil.com.au. Ausbil is the issuer of the Ausbil Global Resources Fund (ARSN 623 619 590) (Fund). You should consider the Offer Documents in deciding whether to acquire, or continue to hold, any financial product. This document is for general use only and does not take into account your personal investment objectives, financial situation and particular needs. Ausbil strongly recommends that you consider the appropriateness of the information and obtain independent financial, legal and taxation advice before deciding whether to invest in an Ausbil financial product or service. The information provided by Ausbil has been done so in good faith and has been derived from sources believed to be accurate at the time of completion. While every care has been taken in preparing this information. Ausbil make no representation or warranty as to the accuracy or completeness of the information provided in this video, except as required by law, or takes any responsibility for any loss or damage suffered as a result or any omission, inadequacy or inaccuracy. Changes in circumstances after the date of publication may impact on the accuracy of the information. Ausbil accepts no responsibility for investment decisions or any other actions taken by any person on the basis of the information included. Past performance is not a reliable indicator of future performance. Ausbil does not guarantee the performance of any strategy or fund or the securities of any other entity, the repayment of capital or any particular rate of return. The performance of any strategy or fund depends on the performance of its underlying investments which can fall as well as rise and can result in both capital gains and losses. Securities and sectors mentioned in this monthly report are presented to illustrate companies and sectors in which the Fund has invested and should not be considered a recommendation to purchase, sell or hold any particular security. Holdings are subject to change daily. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance. Unless otherwise stated, performance figures are calculated net of fees and assume distributions are reinvested. Due to rounding the figures in the holdings, breakdowns may not add up to 100%.