I got hooked on discovery investing when I made a very early investment of 10,000 shares in Aurelian Resources at 30 cents each, just six weeks before the Fruta del Norte discovery in Ecuador, in 2006. Ten months later, they traded north of $40 dollars. Let’s just call this beginner’s luck. Ever since, I have been looking for an even better story, and started the Commodity Discovery Fund in 2008 to pool money to invest in the best discovery plays.

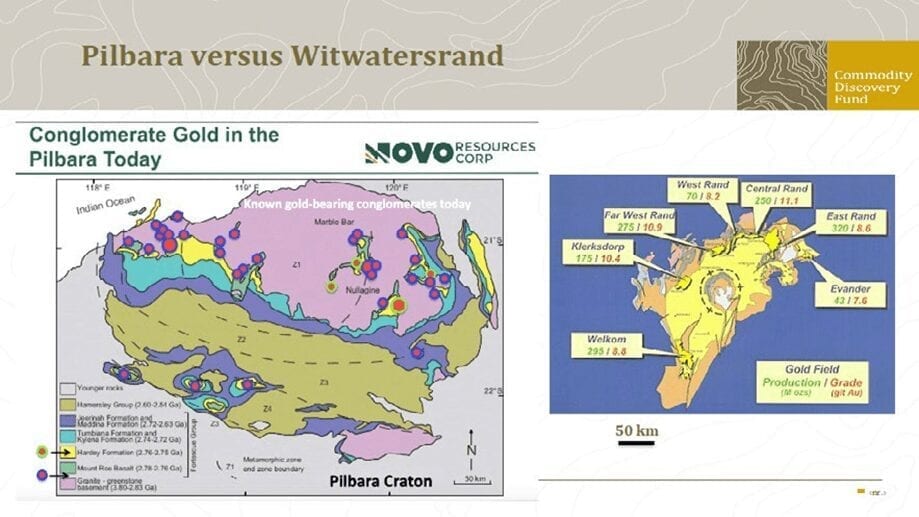

Now, we think that the Pilbara conglomerate gold story could be the next big thing. Since 2017, loads of flat, rounded gold nuggets have been discovered just south of Karratha by two exploration companies – Canadian-listed Novo Resources and Australian-listed Artemis Resources. All of these watermelon- seed-shaped nuggets seem connected to a 2.7 billion-year-old conglomerate ho- rizon. Indeed, that’s the same age as the Witwatersrand deposits in South Africa which, in the last 150 years, produced over 40% of all mined gold, from the same type of gold bearing conglomerates.

After the large investment by Kirkland Lake Gold, Novo shares, and a handful of other exploration companies with huge land packages in the Pilbara, enjoyed a sharp rise in the autumn of 2017, before a severe correction took them down by 70-80%. But now, after a full year of exploration, we have proof that the Pilbara conglomerate system is the result of a single geological event, and may have a close relationship with the Wits event. From West to East, the same style of nugget has been found over the space of 600 km. We don’t think the system is connected throughout and that everything will be gold bearing, but this is a massive system for sure.

During a 2017 Pilbara conference in Perth, an independent geologist stated that the Pilbara gold discovery is ‘for real’ and could be compared to the Wits, although there are huge differences. Another interesting statement was recently made by Kirkland Lake Gold CEO Tony Makuch, who operates the Foster- ville mine in Australia and has invested over $100 million in Novo Resources, together with its billionaire chairman Eric Sprott. According to Makuch, the Pilbara discovery has the potential to ‘turn the gold mining industry upside down’: ‘It’s a potentially very large deposit, physically the gold is there and we were able to trace the gold over 8 km in that one area (Comet Well), and if you tie it all the way toward DeGrey is, you got like 90 km of exposure of conglomerates that you’re finding nuggets and watermelon seeds everywhere […] The way we structured the investment into NVO is the company is financed properly to go and do the work and carry exploration without having to worry about what’s happening in the market.’

Novo ha shown that doing the exploration work is tough because of the nuggety nature of this system. Its chairman, Dr. Quinton Hennigh, who has been on the hunt for a Wits-style gold discovery for most of his career, has decided to start trial mining in 2019. Keith Barron, the geologist who discovered the 10-million-ounce Fruta del Norte deposit in Ecuador, has been checking out the Pilbara discovery as well. After his visit to the Pilbara, he wrote on his blog: ‘Already and at this early stage it is pretty obvious that this is a largish deposit, but it seems to me that almost everyone, except perhaps for Eric Sprott, who has a reputation for seeing value early, has missed the point. What is the point you ask? This thing is ostensibly at surface, so it is like mining placer gold! [..] Quinton has a unique deposit which presents a unique opportunity. You just have to stop applying the usual logic to it and think outside the box […] Let me make a prediction. The Novo Discovery will be the lowest cost gold mine in the industry, by a massive margin. Maybe sub $100/ oz! That’s what should be attracting people’s attention. I can tell you that if this play were anywhere in Africa, Asia or South America, there would be 100,000 plus artisanals on top of it using sledge hammers, pneumatic drills, or pluggers and dynamite to get at the nuggets…and bugger the grade numbers. It is there, it’s going to be mined by someone, and the ultimate grade and origins for the time being are just White Noise.’ This boom- bust scenario is remarkably similar to the first phase of development of the Witwatersrand, home to the richest gold fields on Earth. The Wits has produced over 1.6 billion ounces of gold since the late 1800s, and one billion ounces of gold remain to be mined in current reserves. In the Pilbara, currently no gold mines exist.

The capital of Johannesburg was founded on top of the conglomerate gold discovery in the 1880s. In 1888, four years after the initial discovery, there were already 3,000 people living in Johannesburg. Two years later, there were 30,000, and by 1895, the city had grown into a larger city than Cape Town, with over 100,000 inhabitants. Novo Resources recently added a large land package near Egina, over 100km east of Karratha. In 2019, Novo needs to prove, by test mining the Egina grounds, that they have found a profitable new Wits.

Willem Middelkoop is the founder of the Dutch-based Commodity Discovery Fund. The fund own shares in Novo and Artemis Resources.

I’m a professional geologist and have been exploring & evaluating small and large placer deposits from Fairbanks to Nome to Southwest USA to Chile to Tanzania. I also manage our own placer mines in Alaska. I’ve been a small-scale, narrow vein gold miner, too. Novo’s exploration program has been driving me nuts. I’ve yet to see a cross-section across the paytrends. Widths on the paystreaks seem to be pure speculation. This will prove to be a series of discontinuous paystreaks, similar to what is found in the ancient marine placers of Nome. Count on it. They should be exploring this beast like it’s a placer deposit, because…. it is a placer deposit. Someone on that crew needs to read Wells “Placer Examination” or Don Cook’s “Placer Mining in Alaska” to see how a drill hole or test pit pattern is laid out to define a placer resource.

In the meantime, mine the damned thing already! It’s not that hard. You do have to be careful of dilution in the deeper portions of the deposits. The gold-bearing units are very thin and so large pits will be required to provide enough pay to satisfy a commercial scale operation. Set reasonable and achievable goals. The first step is to try to produce 200 oz from an identified hotspot with a pilot plant. And for goodness sake, don’t ship the ore a hundred miles to a lab. Do it on site. A simple jaws to an impact mill and then put over a sluice or a jig. Find out what you can recover with a simple process first. Find the limits of the hotspot. Then evaluate what worked and what didn’t work, make the improvements and try to produce 1,000 oz on the next iteration. Then, go for 3,000 oz. Then set up another mining unit at another location and try to produce 6,000+ oz. Increase production by adding portable mining units at different locations. This is how it’s done on a placer deposit, even on a large scale. Man, I wish they would cut me loose on this thing and let me do what I know to do.