Firefinch Limited (ASX: FFX) has confirmed that the final condition with respect to Jiangxi Ganfeng Lithium Co. Ltd’s investment into the Goulamina Lithium Project in Mali has been satisfied.

The trigger for funding follows the transfer of the Exploitation Licence for the Goulamina Lithium Project to Lithium du Mali SA (LMSA) a wholly owned subsidiary of the JV Company.

Firefinch and Ganfeng now each hold a 50% interest in the JV Company and follows the satisfaction of all other conditions precedent including securing a ”letter of no objection” from the Malian Government in relation to Ganfeng’s investment into the JV Company and the parties agreeing to make a Final Investment Decision in respect of the Project.

The satisfaction of the conditions precedent triggers US$130 million of equity funding to be provided to the JV Company by Ganfeng, with US$39 million to be released from escrow and received by the JV Company and a further US$91 million is due to be transferred to the JV Company by Ganfeng in the coming days.

Ganfeng is further obliged to provide either US$40 million of Ganfeng direct debt or source US$64 million of third-party debt. Taken together, Ganfeng’s debt and equity funding package of at least US$170 million is expected to substantially fund the Project through the development phase.

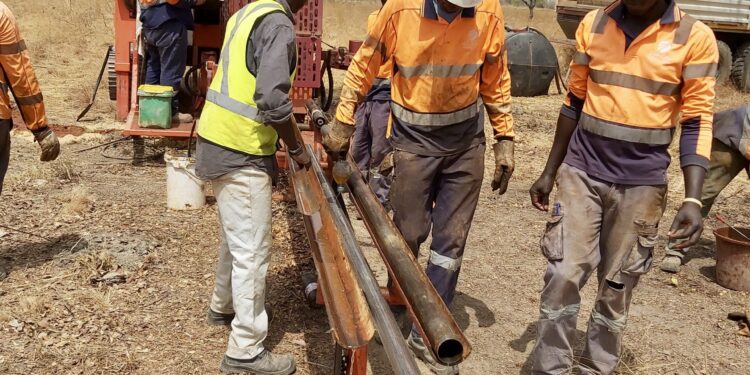

Importantly, the procurement and tendering of long lead items for the Project is already underway to accelerate the commencement of construction. Tenders for the ball mill and crushing equipment are expected to be released to providers in early April, well ahead of Leo Lithium Limited’s likely listing date to the ASX.

Ganfeng is assisting with tenders to be sent to their supplier network in China. The demerger of Leo (the Firefinch group entity which holds the company’s interest in the JV) from Firefinch (Demerger) can now proceed. In the coming weeks, Firefinch will issue a definitive timeline for release of the Notice of Meeting and accompanying short form prospectus. If the Demerger is approved by Firefinch shareholders, Leo expects to undertake a pro-rata entitlement offer and seek admission to the official list of ASX.

Firefinch Managing Director, Dr Michael Anderson, said this is a long awaited and significant milestone.

“We have been working tirelessly to progress the joint venture and demerger process to deliver value for shareholders and are delighted to be on the brink of achieving the intended result,” Dr Anderson said.

Leo Managing Director, Simon Hay, said this is this a tremendous step along the path to listing Leo Lithium and developing Goulamina as one of the world’s largest lithium producers.

“The combined debt and equity funding package of at least US$170 million from Ganfeng means Leo can now accelerate work on the Goulamina Project.

“Behind the scenes we have been working with our partner Ganfeng, who will provide funding, offtake and operational support to significantly de-risk development.

“Assuming the approval of Firefinch shareholders, the demerger will bring Leo Lithium to life. I’m incredibly excited about the opportunity ahead and look forward to hitting the ground running come listing.”

For further information please visit: https://firefinchltd.com/