Kopore Metals Limited (ASX:KMT) has entered into a binding agreement for the sale of 100% of its interest in its Namibian exploration property to Sandfire Resources Limited subsidiary Metal Capital Exploration Ltd.

Sandfire has agreed to purchase 100% of the issued capital in Trans Kalahari Copper Namibia (Proprietary) Limited (TKC), the wholly owned subsidiary of Kopore that holds the Namibian exploration properties.

Kopore’s Managing Director, Simon Jackson, said the transaction with Sandfire provides certainty of funding for Kopore in the current challenging markets and allows the company to move ahead with planning its next exploration programmes in Botswana, which are expected to commence once COVID-19 restrictions are relaxed.

Sandfire will pay upfront consideration of $1 million cash and $1 million in Sandfire shares, calculated based on Sandfire’s five day VWAP at closing. Additional deferred consideration may be payable to Kopore if Sandfire reaches a “Decision to Mine,” based upon the following Ore Reserve thresholds on a contained copper basis:

- Ore Reserve of >300kt but <500kt Cu $1.5 million; and

- Ore Reserves of >500kt Cu $3.5 million

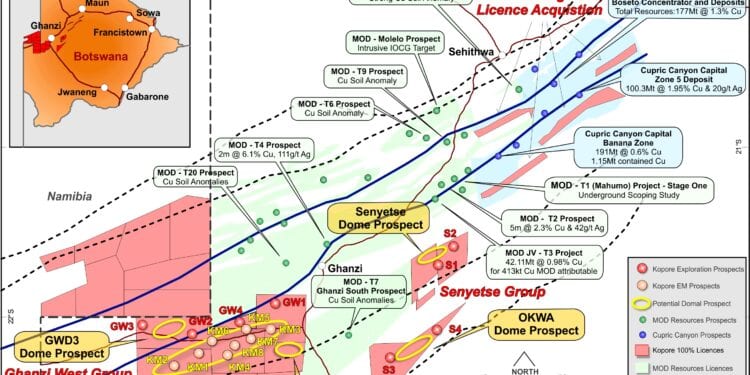

Kopore retains its fourteen prospecting licences in Botswana where it has a land holding of approximately 8,126 sq. km.

“The Transaction with Sandfire allows Kopore to move forward with sufficient capital and avoid excessive shareholder dilution at current share prices.

“Funding Kopore’s large prospective land holding whilst maintaining the company’s capital structure required some lateral thinking. We think this transaction provides our shareholders with the best of both worlds with zero dilution.

Namibian exploration is in the capable hands of one of the largest land holders in the Kalahari Copper Belt with Kopore shareholders remaining exposed to the upside of a future discovery and mine development. Kopore retains its 8,126km2 land holding in Botswana with multiple highly prospective and under explored targets.

I think the Transaction is particularly pleasing considering the current COVID-19 crisis and we think the sale of a portion of our assets for a total consideration approaching the market capitalisation of the Company is an excellent outcome for Kopore shareholders. We look forward to sharing details of our next exploration steps soon.”

Mr Jackson said it is anticipated that Kopore’s next steps in Botswana will include:

- An initial RAB/RC drill programme at the Virgo Prospect to test two copper soil anomalies and coincident geophysical anomalies. These licences have never been drilled by Kopore. Following receipt of the Environmental Management Plan in January 2020 the Company is now able to commence drill activity. The two Virgo Prospect copper anomalies are within 34km of Cupric Canyon’s Zone 5 Copper Silver Project (91.7Mt @ 2.13%Cu & 21.9g/t Ag resource1), currently under construction;

- Airborne electromagnetic (EM) survey covering the highly prospective Kara Domal Prospect, close to the Namibian border and along strike from Sandfire’s T3 deposit; and

Follow up drilling programme at the Kara Prospect, aiming to test potential identified EM targets.