Gold is never easy. So many factors influence the gold price., it is impossible to predict bullion’s short-term reactions to individual economic or geopolitical developments. To us, gold’s portfolio utility is shaped by long-term fundamentals and epic structural imbalances. Excessive global debt and related monetary debasement have been decades in the making. There will be no quick fix for a global economy weaned on emergency liquidity. Given economic pain implicit in debt rationalisation, central banks will always strive to delay the inevitable recalibration of bloated financial claims to underlying productive output. In the meantime, gold remains a potent portfolio diversifier buffeted by a steady stream of short-term trading cues and knee-jerk reactions. Without question, the most trying times for gold investors are periods when big picture fundamentals are aligning solidly in gold’s favour, yet the market chooses to trade gold based on perceived correlations with short-term movements in other asset classes.

The summer of 2018 has shaped up as just such a frustrating stretch. The Fed’s dual policy agenda of simultaneous rate hikes and balance sheet reduction has ratcheted up peripheral financial stress at a pace faster even than we had anticipated. To date, though, cognitive dissonance over the US dollar’s contributing role has preserved its safe harbour status. As the scale of emerging market dislocation expands on a weekly basis, the stored force in collapsing EM currencies is still funneling towards a strengthening dollar and, in turn, reflexively pressuring the gold price. Even the weekly circus of President Trump’s impetuous tariff crusade, as unsettling as it has been for market confidence, has thus far weighed on gold through the tractor beam of a collapsing commodity complex. Do the headlines of the past three months really suggest gold’s portfolio merits are diminishing? (fig.1)

From year-end 2016 through 4/16/18, a 12.5% decline in the DXY Dollar Index supported a methodical 16.8% gain for spot gold. Then in mid-April, as shown in Figure 1, above, everything changed. All of a sudden, the US dollar regained its mojo, bolstered by 10-year Treasury yields surging through 3%, a hawkish FOMC, favourable global capital flows, strong S&P earnings and whispers of 5% Q2 GDP growth. Since the dollar’s 4/16/18 turn, the DXY Index has rallied a crisp 8.1% through 8/15/18, while spot gold has retreated 12.7%. As discussed in our July report, gold’s prospects for the balance of 2018 and beyond will be heavily influenced by the US dollar’s relative strength. Updating the list of factors we cited for the dollar’s mid-April turnaround, 10-year Treasury yields have already retreated back below 3% (ominously in concert with a collapsing yield curve), the FOMC is having to resort to unprecedented measures to keep the effective Fed funds rate from squirting above its targeted range, strong S&P earnings are being exposed as the reciprocal of an exploding federal budget deficit and reported Q2 GDP growth turned out to be fairly lame in the context of super-charged fiscal stimulus. Despite gold’s star-crossed performance during the past three months, we remain confident that the DXY’s summer strength will soon prove to have been a counter trend rally within an extended decline.

Full Dollar Boat

Perhaps emblematic of late-cycle financial markets, the recent rush to unanimity in dollar bullishness has been literally “off the charts.” The venerable Bernstein Daily Sentiment Indicator (DSI) has been quantifying sentiment across U.S. futures markets every trading day since April 1, 1987. The DSI scale ranges from a low reading of 1% bullish to a high reading of 99% bullish. On 8/14/18, the DSI for the US Dollar Index measured an eye- popping 96% bullish. To give some perspective to how rare a 96% reading actually is, during the entire 7,966-trading-day history of the DSI for the US Dollar Index, the buck registered a more bullish reading on exactly five days. Needless to say, when traders are 96% bullish any currency, there is not much left for the other 4% to accomplish! Similarly, the 8/13/18 DSI for spot gold registered an almost-as-rare reading of 6% bullish (94% bearish). During the entire 7,938-trading- day history of the DSI for spot gold, a more bearish reading has occurred on only 48 days.

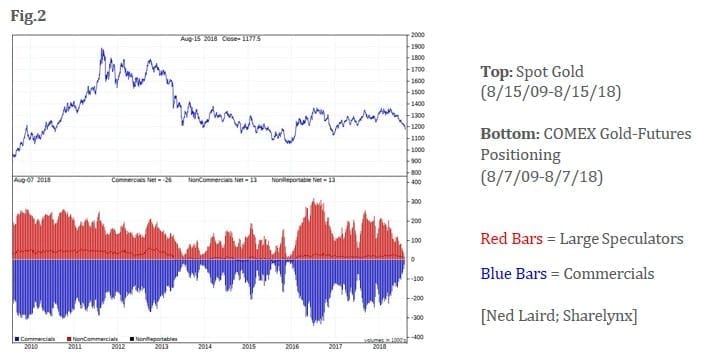

Cranky COMEX

At least in Western markets, short-term prices for all commodities are heavily influenced by positioning on COMEX. With scant position limits, 4% margin requirements and no need to pre-borrow collateral to sell short, COMEX is the ‘Wild West’ of US securities exchanges. Anyone with a multi-billion-dollar hedge fund and a view is welcome. Every week, the US Commodities Futures Trading Commission releases its Commitment of Traders Report, disclosing aggregate outstanding positions for all traded commodities. The COT reports organise trading firms into general categories of ‘speculator’ and ‘commercial’ participants. In the gold space, the speculator designation includes money managers, hedge funds and CTA’s, and the commercial designation is composed of jewelry manufacturers and bullion banks. Historically, speculators are always net long and commercials are always net short (jewelry manufacturers’ sole goal is to hedge their precious-metal inventories). Commercials are overwhelmingly viewed as the ‘smart money’ in the gold trade, because bullion banks have far superior visibility (compared to specs) into order flows and supply/demand dynamics, extremely deep pockets and, most importantly, are virtually immune to the pain of mark-to-market losses when representing their best customers (central banks). As shown in Fig.2 above, positioning in COMEX gold futures during the week ended 8/7/18 had become virtually unprecedented. In the bottom panel, the red bars represent the net-long positions of large specs, the overwritten lines near the bottom of the red bars represent the net-long positions of small specs (not considered relevant for analysis), and the blue bars represent the net-short positions of the commercials. Because futures are zero-sum markets (for every long contract there is a precisely offsetting short contract), the blue bars always represent a mirror image of the two red bar components. As of 8/7/18, the net-long position of large specs had contracted to just 12,688 contracts, and the commercial net-short position had contracted to just 25,609 contracts (zero-sum difference being a 12,921 net-long position held by disregarded small specs), both new lows dating all the way back to the week of 12/1/15, which marked the end of spot gold’s four-year bear market and kicked off bullion’s 31.4% rally during the first half of 2016.

Interestingly, the dynamic behind the collapse in the large-spec net-long position has been an explosion in gross shorts by hedge funds (not their normal bailiwick). In the eight weeks between 6/12/18 and 8/7/18, large specs actually increased their gross longs modestly, from 192,752 contracts to 208,292 contracts, but over the same span almost tripled their gross shorts, from 72,512 contracts to 195,604 contracts. While we tip our hat to hedge fund prescience in aggressively establishing gold shorts these past eight weeks, it will now require re-purchase of the equivalent of 12.3 million ounces to determine the degree to which recent hedge-fund bearishness has been self-fulfilling. In the meantime, participating hedge funds should find it a bit ominous that their highly atypical gross short position (195,604 contracts) currently exceeds the gross short position of the wily commercials (179,812 contracts) for the first time in the history of these statistics! Classic!

Dollar Dogma

We find two basic flaws in prevailing dollar-bullish reasoning. First, it relies on long-standing relationships between asset classes which hold diminished relevance amid contemporary realities of excessive global debt levels and systemic fragilities. Citing just one of many examples, dollar bulls are content to extrapolate Fed tightening as telegraphed, and conclude that FOMC policy divergence will simply power a strengthening dollar as it always has in the past. This reasoning, however, sidesteps the likelihood that existing debt levels have become too onerous for the Fed to tighten meaning fully without triggering a damaging wave of debt defaults. We would cite the collapsing Treasury yield curve in concise counterpoint to dollar bulls’ expectations for rising US rate structures. For the past 37 years, any meaningful backup in 10-year Treasury yields has quickly led to financial crisis. Why do dollar bulls think US rates are suddenly free to rise without causing collateral damage today, when they have been unable to do so for almost four decades?

Second, bullish dollar arguments turn a blind eye to rapidly hardening global resentment of the dollar standard system. Historical burdens endured around the globe from unilateral impacts of Fed policy pale in comparison to President Trump’s outright weaponization of the US dollar. By way of recent example, Russian resentment of President Trump’s capricious April sanctions on selected Russian companies spurred the Russian central bank to liquidate $81 billion of Treasuries within weeks. Along with levying metal tariffs on Canada, Mexico and the EU, the Trump administration has now imposed sanctions on no fewer than 11 countries: China, Columbia, Cuba, Iran, Libya, North Korea, Pakistan, Russia, Syria, Turkey and Venezuela. As if Triffin dilemma strains were not burdensome enough for the archaic dollar standard system, President Trump is now expanding the dollar’s role well past being a stable unit of account or serving as a global reserve currency, to becoming a blunt instrument for punishment of nations not on board with the Trump agenda. Are dollar bulls so jingoistic they believe the world has no choice but to accept a global monetary framework subject to borderline blackmail?

Periphery to Core Accelerating

In our June report, we employed periphery-to-core analysis in documenting incipient financial stress in emerging market economies. In recent weeks, Turkey has become the blazing focal point of what clearly threatens to become a rolling EM contagion. As would be entirely expected, consensus still emphatically dismisses Turkey’s plight as isolated, because other EM’s don’t share Turkey’s unique mix of toxic fundamentals. Needless to say, we find the rush to containment highly amusing because it misses the seminal nature of what is transpiring in Turkey. Analysts focused on schedules of Turkish external obligations are confusing analysis of ‘ability to pay’ with assessment of ‘willingness to pay’. To us, it seems clear President Erdogan has determined that Turkey’s debt obligations are too onerous to service now that the era of free central bank credit has ended, and he is proactively positioning Turkey for absolution of its external burdens. Along the way, he has effectively baited President Trump into aggressive actions which have decimated the Turkish lira, facilitating the perception, at least in Mr. Erdogan’s neck of the woods, that it is the Turkish President who is assuming the high ground. Mr. Erdogan’s fiery vernacular should be signaling to Wall Street that the situation in Turkey is well past the point of spreadsheets and debt-service models.

I call out to those in the United States. You cannot tame our people with threats…Those who assume they can bring us to our knees through economic manipulations don’t know our nation at all. If they have got dollars, we have got our people, our right, our Allah…Failure to reverse this trend of unilateralism and disrespect will require us to start looking for new friends and allies. These words do not sound like a leader who is concerned about the impact of a 40% lira collapse on the serviceability of Turkey’s $467 billion external debt (50% of Turkish GDP). It seems increasingly likely that President Erdogan will soon impose capital controls, effectively defaulting on Turkey’s external obligations. What we are witnessing may be an emerging blueprint for debt resolution in countries feeling exploited by a decade of unlimited, no-questions-asked central bank liquidity which, in essence, has provided a Western rope for developing countries to hoist their own petards (fig.3)

To us, President Erdogan’s populist blueprint has broader applicability than just a few basket case EM economies. As shown in Figure 3, above, South Africa, Argentina, Mexico, Indonesia, Brazil and Russia, with $2.4 trillion worth of total offshore debts (denominated in various cfurrencies), look like prime candidates for an Erdogan-like approach. Populist defiance is a logical step for an overly indebted world in which 10 years of emergency monetary policies haven’t accomplished a damned thing other than compounding obligations of servitude. A eureka moment for gold will be when consensus finally recognizes that rolling financial stress in emerging and more developed markets is not being triggered by anything country specific, but instead by the single but universal development that after flooding the world with cheap credit for 10 years, the Fed is electing to drive the cost of dollars up and their availability down. This is not just an emerging market issue—all countries are in the same boat. Debt levels are absurd everywhere, all the way to the top of the debt pyramid in the United States. The only unknown is how far up thechain the Fed is prepared to drive the process of global debt rationalization.

Domestic Dollar Hurdles

Here at home, we see two prominent hurdles to protracted dollar strength: over hyped US growth prospects and a rapidly deteriorating US fiscal position. With respect specifically to Q2 GDP, the ever cheerful David Rosenberg and his Gluskin Sheff team helped us slice and dice the 4.1% GDP gain down to its starkly unflattering components. First, David points out that US real GDP has historically improved on the order of 3 ½% in quarters immediately following large fiscal stimulus (Kennedy, Reagan, Bush 43 twice, and Obama), so assuming recent trend growth of 2 ¼%, Q2 should have registered at least a 5 ¾% gain. Despite widespread celebration for having achieved the elusive 4% handle, Q2 GDP of 4.1% was actually a dud right out of the box. Worse still, David has convinced us (by way of signature Rosenberg math) that three non-recurring Q2 items added roughly 170 basis points to the final GDP tally. By subtracting 90 basis points for a tax-cut induced savings-rate drawdown (Q2 delta of a 4% personal consumption increase over a 2.6% gain in disposable income), 60 basis points for a boost in soybean exports (motivated by transitory effects of tariff schedules), and 20 basis points for an outlier defence spending number, 4.1% Q2 GDP gets whittled down to a sustainable real growth rate closer to 2.4%, or only two-thirds of the anticipated fiscal boost itself! Others may accuse David of cherry picking GDP components, but as he loves to point out, “This is analysis, not reporting.” David’s work unequivocally suggests the US housing sector (the portion of GDP with the most reliable leading attributes and the most powerful multiplier effects) is firmly in recession. The 1% contraction in Q2 residential fixed investment, on the heels of a 3.4% swoon in Q1, satisfies the technical recession definition (not to mention declines in four of the past five quarters—a pattern not seen since the depths of the recession between Q4 2008- Q1 2010), but recent industry trends paint an even grimmer picture. During the past three months, amidst a generally bullish economic narrative, housing starts have collapsed at a 39% annual rate, building permits have receded at a 23% annual rate, new home sales have declined at a 22% annual rate and existing home sales have contracted at a 15% annual rate (fig.4).

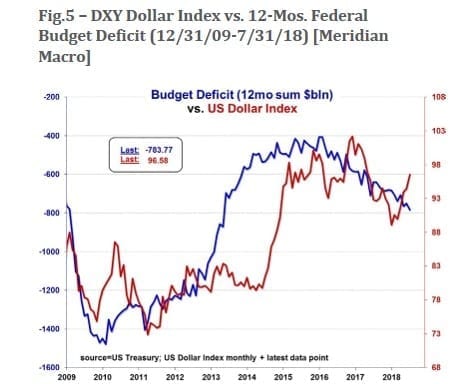

Finally, beneath residual momentum in growth and small-cap sectors, David cites a growing list of domestic cyclical groups, including home building, autos, transports, media and various retailing groups, which are beginning to signal “sharply decelerating growth.” Coincidentally, as shown in Figure 4, above, the mid-April liftoff for the DXY Index has occurred precisely as the Citigroup US Economic Surprise Index has turned sharply lower. Stay tuned! To us, the dollar’s most significant challenge is the rapidly deteriorating US fiscal position. Surprise, surprise, the Treasury Department reports that Trump corporate tax cuts have reduced first-half 2018 tax revenues far more than expected. H1 year-over-year corporate tax receipts fell by a third, greater than the 2009 collapse and near a 75-year low (nominally and as % of GDP). The Trump administration OMB mid-year review (July) tacked $100 billion to annual budget deficits for each of the next several years (2019-21 now $1.1T, $1.1T and $1.0T). As shown in Figure 5, below, the DXY’s summer rally is likely to be overwhelmed by harsh budget realities in very short order. Should historical relationships hold true, a DXY target in the low 80s should be in play by mid-2019 (fig.5)!

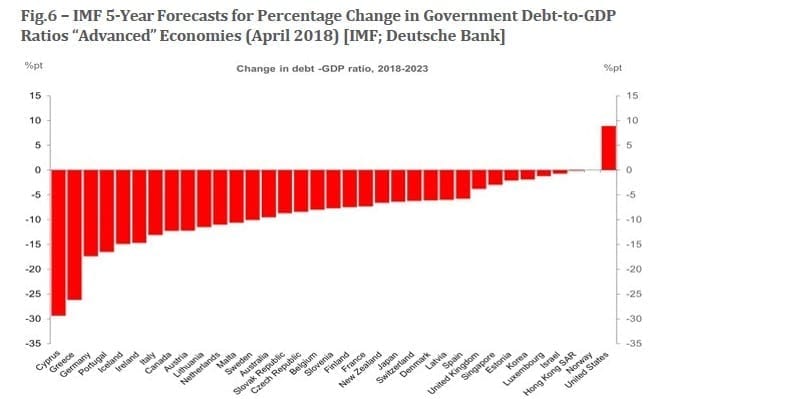

In our 36 years in the investment business, we have learnt that, at least in the short run, the market is never wrong. Given our analysis of macro and monetary fundamentals, which we have tracked for over 15 years, we are a bit stunned by gold’s performance during the past few months. It is neither the first nor the last time we will be humbled by gold’s uncompromising autonomy. As my wife occasionally consoles me, “gold is not a trained seal.” Nonetheless, we maintain high confidence that a portfolio commitment to gold offers enormous portfolio utility intoday’s complex and treacherous investment environment. We encourage Sprott clients to exploit summer price movements in precious metals to their maximum advantage. An extraordinary opportunity is now presenting itself (fig.6).

During the final four months of 2018, we expect euphoria over ‘strong’ S&P Q2 earnings to fade into consensus recognition that corporate profits have been financed through the zero-sum misdirection of an exploding federal budget deficit. As the Treasury conducts its second half issuance now projected to total $769 billion (bringing total 2018 issuance to $1.33 trillion), we expect significant erosion in feverish dollar sentiment now in play. Additionally, as shown in our Addenda graph, modest 2018 upticks in the average interest rate paid on US public debt are already straining Federal budget projections with geometric increases in debt service obligations. As final perspective on the

US fiscal position, we offer in Figure 6, above, the IMF’s five-year forecasts for percentage change in government debt- to-GDP ratios in “advanced economies.” Note there is only one nation projected to increase its debt-to-GDP ratio during the next five years. Does this look like a recipe for relative dollar strength? While gold is never easy, we still like its chances!