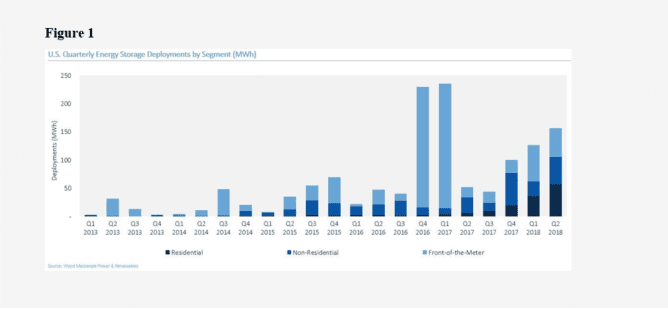

The North American residential energy storage market has recently made headlines. For the first time, it has outpaced the Front-of-the-Meter (FOM) market and non-residential segments. The FOM market consists of very large commercial and utility-scale projects that create a significant amount of variability in quarterly or annual installations.

Residential energy storage installations are heavily connected to solar PV installations, which establish a good platform from which the technology can launch. The residential solar PV market in North America is considered to be mature, but lithium-based energy storage systems are new additions that have only gained market traction in the past 12 months.

Although the concept of attaching lead acid batteries to solar PV arrays is not new, lithium-based storage technologies are now significantly more advanced, persuading more homeowners to invest in these solutions. Only in the past three quarters have residential energy storage sales in North America taken flight. As reported by Wood Mackenzie Power & Renewables, in Q2 2018 the market installed approximately 60MWh of storage systems – that’s 4,300 residential properties fitted – based on an average system size of 14KWh. Based on the first two calendar quarters of 2018, the industry may finish this year with around 200MWh of storage systems, or 14,000 residential energy storage systems installed. These figures represent the equivalent of approximately 25,000 hybrid vehicles or 3,000 electric vehicles.

GTM Research forecasts that the North American market will pass the 1GWh milestone of installed residential energy storage systems before 2020. Also, the firm projects that from 2017 to 2023, the industry as a whole will grow 17X to an annual value of $4.3 billion. The 1GWh milestone represents over 70,000 systems with fewer than 15,000 systems to be installed by the end of 2018. This clearly illustrates that the market is well positioned to achieve rapid growth over the next 24 months, with much potential beyond 2020. Ac- cording to the Solar Energy Industries Association, the North American residential solar market installs approximately 300,000 systems per year, indicating that less than 5% of the market is installing storage with new solar systems.

There are numerous demand drivers for residential energy storage and solar PV systems in North America, but the most dominant scenarios are:

Backup Power – Provides the unique ability to act as an island in the event of a grid failure, keeping the PV array producing power. The PV power is fed into an essential or protected loads panel, providing clean backup power during a power outage.

Net Metering 2.0 – Removal or change of net metering programs across the country and various Caribbean islands, controlling PV saturation, grid stability, a fair distribution of transmission cost, and utility revenue.

Time of Use Rate Structures – The implementation of various rate structures that place the highest cost of electricity during evening timeframes.

Looking forward, the key components to the wide-scale adoption of energy storage systems will include the continuing price decrease for both lithium battery and balance of system components, increasing system functionality, changing government and utility policies and mandates, increasing consumer awareness, and product financing options.

For all of the above reasons, lithium-based energy storage systems have won the race in the residential segment of the market. The competing alternative to lithium battery systems are a variety of lead acid-based systems that are slowly being phased out of the market. In fact, today in North America, the vast majority of residential battery installations of meaningful capacity are lithium systems. Lithium has been able to displace lead acid based on a superior product warranty of 10 years compared to three years, plus an extended life expectation of 20 years compared to only five years. Furthermore, lithium systems offer a tight product form factor due to the energy density of the batteries – they are lightweight, easy to install, and they require no additional ventilation or specialised mechanical equipment. The energy storage systems can be installed indoors, or outdoors in warmer climate markets, they are aesthetically pleasing, and they have a user interface that allows homeowners to connect with their energy storage system and solar PV array in order to best understand their overall energy profile. Most importantly, lithium-based energy storage systems are wrapped with intelligent energy management software that will continuously optimise energy requirements based on the amount of solar PV production, the state of charge of the battery, the weather forecast, the utility rate structure, and other variables.

With no obvious alternatives to lithium batteries in residential energy storage systems, and a growing number of solar customers looking to add storage to their systems, it is clear that this will remain a high-growth opportunity for the lithium supply chain. A primary concern for this segment of the market is the availability of battery modules to allow for steady growth, since larger brands such as Tesla Mo tors remain focused on increasing electric vehicle production, while battery manufacturers tend to shift towards utility scale battery parks to move volume. Pure play energy storage outfits such as Canada-based Eguana Technologies (www.EguanaTechnologies.com), Maine-based Pika Energy (www.pika- energy.com) or German-based sonnen- Batterie (www.sonnen-batterie.com), all of which integrate batteries provided by LG Chem, Panasonic, and Sony, are best positioned to bring solutions to market.